Housekeeping

Before we get into the meat of this week’s roadmap, a bit of housekeeping: if you haven’t yet reviewed our latest healthcare update, now’s a good time. It extends our core thesis and highlights a handful of under-the-radar biotech names we believe are set to outpace the field thanks to both cyclical momentum and strong positioning within the value-based care shift. Link below.

Also heating up?

Our “Phase 3” AI basket, a high-conviction portfolio of names riding the AI deployment wave. Since April, this group has outpaced the S&P 500 by more than 2x, and in our view, it’s still in the early innings. If you’re looking for what to scoop up on the next pullback, start here:

Now, let’s dive in…

Tariffs, Tailwinds, and Tactical Tilts: Setting the Stage

Markets tiptoed through a relatively quiet macro backdrop this past week. But by Thursday, a better-than-feared Nonfarm Payrolls print gave traders something to cheer about, helping major indices end on a high note. Earlier in the week, we saw classic de-grossing: winners were trimmed, laggards were bought. That rotation benefited small caps and the Dow, while the Nasdaq 100 lagged, though still managed a respectable +1.5% weekly gain.

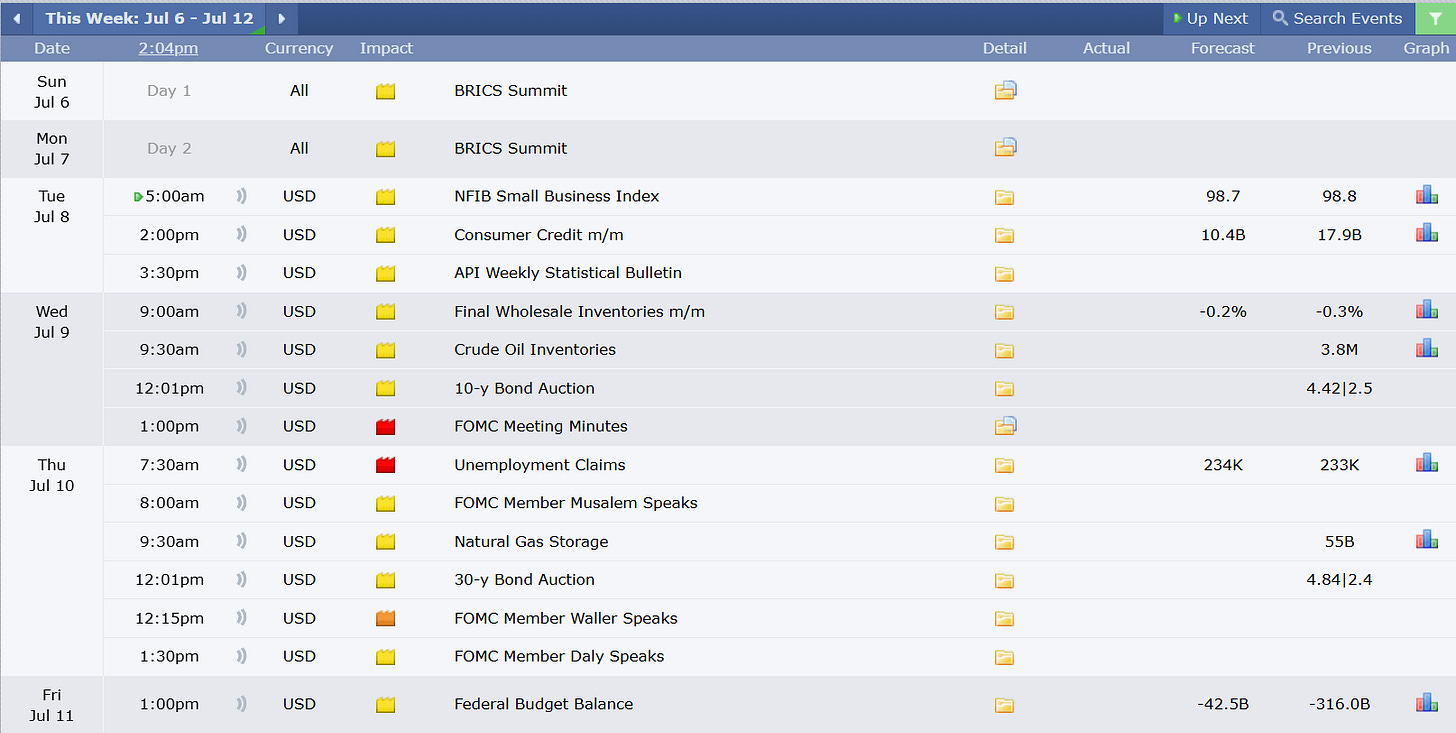

Looking forward, the calendar is light on fireworks… A few routine bond auctions and the usual FOMC minutes are on deck, plus the weekly jobless claims. But circle July 9th, that’s when the temporary tariff delay enacted after Liberation Day officially expires. Whether we see last-minute trade deals or a hard shift toward tariff enforcement (as hinted by Trump’s August 1st deadline) remains to be seen. Either way, that’s your geopolitical risk flare for the week.

The Rally and Real Risks: Parsing SPX

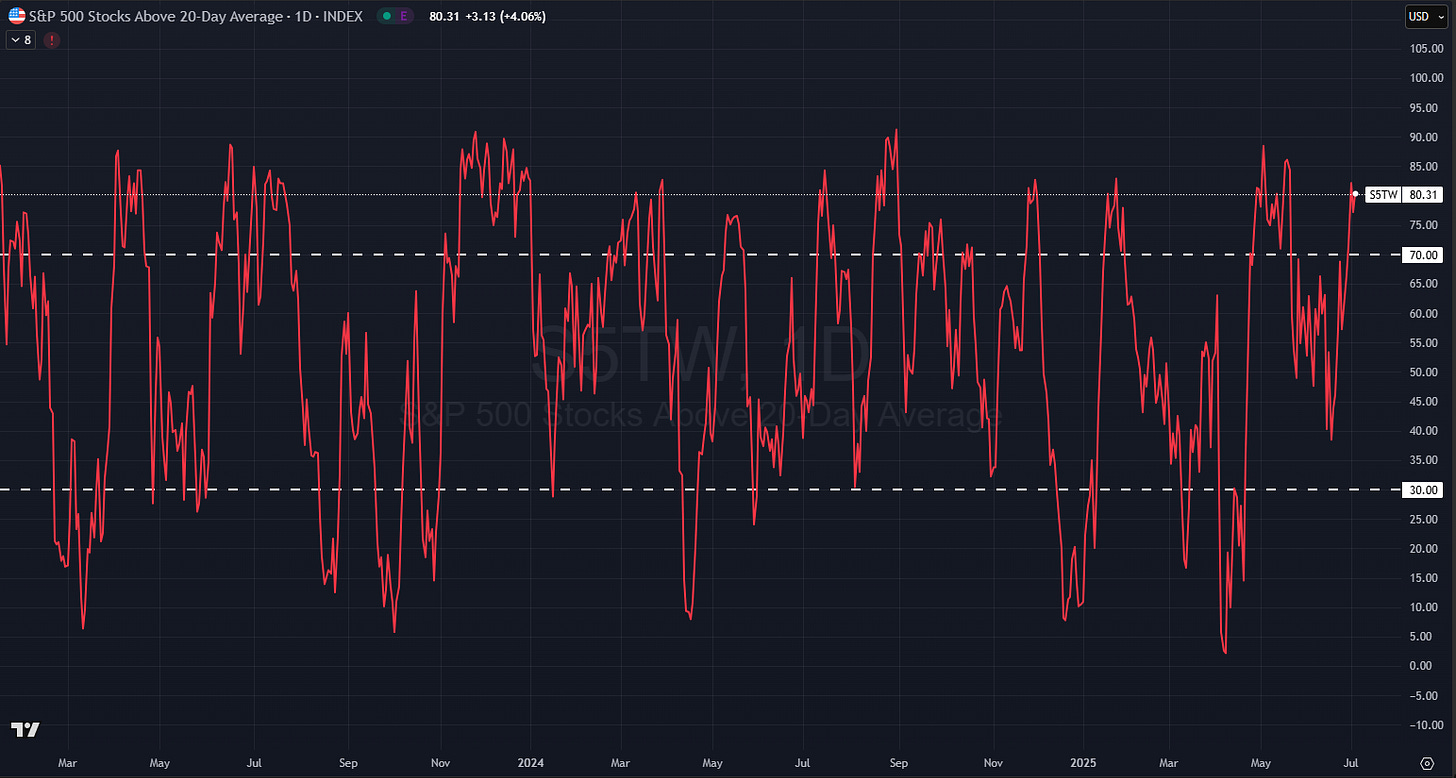

The S&P 500 continued its gravity-defying grind higher last week, notching yet another all-time high and closing just under the 6300 mark. It wasn’t just the headline level that impressed, market internals showed strong signs of broad participation. The advance/decline line surged, signaling that this wasn’t a narrow melt-up powered by a few megacaps. In fact, 80% of SPX stocks now sit above their 20-day moving averages… a sign of strength, yes, but also a signal we’re edging toward overbought territory. Some chop or sideways drift wouldn’t be surprising here.

The Forces Behind the Rally

The usual suspects were in play: dovish rate-cut optimism, better-than-expected labor data, and the long-awaited passage of the administration’s BBB legislation. The NFP report beat expectations and even saw upward revisions to prior months, yet another data point defying the doomers.

Breadth broadened, risk appetite held, and equities levitated.

But while the index soared, institutional hands were absent. Fund flows reveal that large investors have been net sellers for eight consecutive weeks. Positioning remains light, a quiet but powerful tailwind for any rally…

Tariffs Enter the Chat… Again

This week, the spotlight shifts to trade. July 9th marks the expiration of the temporary tariff delay first introduced post-Liberation Day. Trump, never one to miss a chance to stir the pot, made headlines by reaffirming his August 1st enforcement date. But there’s nuance: countries that negotiate in “good faith” may earn themselves a 10–20% tariff. Others? They’re staring down the barrel of 60–70%.

The Vietnam deal gives us a glimpse into how this game is being played:

Vietnam drops its tariffs → U.S. slaps on a 20% rate for imports and 40% for transshipped goods.

The market didn’t flinch, likely because the new deal still marks a reduction from the prior 46% rate.

Bottom line: the administration’s math might be fuzzy, but they’re angling for deals, not destruction.

From April to now, here’s what we’ve learned:

The administration does have a pain point, namely bond market volatility.

There’s no appetite for a recession.

Tariff announcements are more bark than bite.

Other countries know the U.S. is negotiating from a weaker position.

Looking Beyond the Headlines

Investors seem to have developed a thicker skin. Back in April, trade war whispers sent shockwaves. Today, they barely move the needle. Only two official trade deals have materialized (U.K. and Vietnam), and yet SPX is now over 150 points above February highs.

It turns out a bit of rhetorical softening, plus a whole lot of underexposure, goes a long way.

The Setup Into Next Week

Expect a quieter data slate, but the tariff story will take center stage. The market is watching how deals unfold with heavyweights like China, the EU, and Japan. Less so with Canada and Mexico.

Technically, the bull-gap from Thursday’s post-NFP pop sits around 6240. If bulls can defend this level, we’re likely to see continued churning and consolidation near the highs before the next leg up. If that gap fills, eyes shift to:

6100 / 6050: previous highs and stronger support

5850 range: the last consolidation zone, now buttressed by the 200-day moving average.

As earnings season kicks off in July and August, two things will matter:

Do results beat conservative guidance?

More importantly, are the beats big enough to justify rich valuations?

Tariffs filtering into inflation prints could also be a curveball or a catalyst. If pricing pressures remain muted, the Fed gets more room to act…

QQQ: A Slow Grind Higher, with Depth Below

The Nasdaq 100 may have been the “laggard” last week, but that’s a relative term. QQQ still notched a gain of 1.56% and tagged yet another all-time high. The real story here isn’t weakness, but rotation.

Importantly, QQQ carved out a fresh bull-gap near 552.5, a level worth watching. If bulls can defend that zone, we expect the grind higher toward 560 to resume — and from there, potentially extend even further. But given how stretched broader indices are on shorter-term timeframes, don’t be surprised by a pause or a modest retrace to reset conditions.

Key levels to watch:

541 → Prior highs from February

515 → Major MA cluster (50D, 200D) and Yearly Open; bull line in the sand

Positioning still appears light in the mega-cap AI complex, which adds fuel for future upside if we continue to see soft macro data and dovish Fed posture.

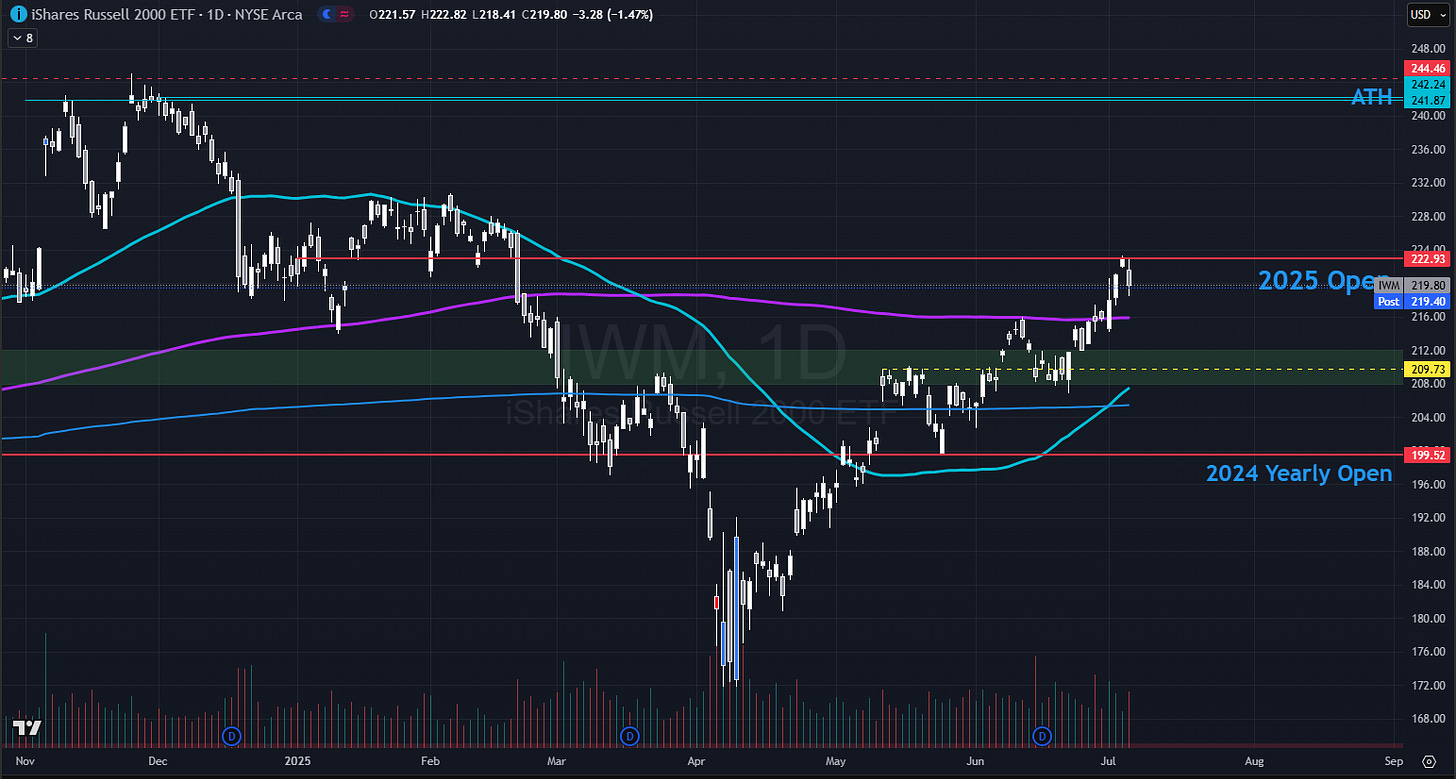

Small-Caps Take the Torch: The Pain Trade Accelerates

A couple weeks back, we flagged small-caps as a classic “pain trade” and last week that theme played out with force. The Russell 2000 (IWM) surged ahead, outpacing both SPX and QQQ, driven by factor rotation and the revival of cyclical names like banks, housing, and real estate.

This is happening for a reason:

Positioning is historically light in small-caps.

Dovish rate expectations and improving soft/hard data provide macro cover.

The July 2024 setup is still fresh in traders’ minds… when IWM and QQQ rallied ~20% in three weeks on the back of a surprise inflation beat.

If July’s inflation data comes in soft again, and especially if the Fed stays dovish, expect another violent upside move in IWM.

Technical outlook:

The A/D line for small-caps just broke out — breadth is broadening.

IWM cleared its 200-day moving average with conviction.

Upside targets:

230 -240 → Extension of current breakout

Support zones:

216 → Recent breakout pivot + 200D

200 → 2024 yearly open (must hold for constructive medium-term view)

Unless hard data weakens or tariff-induced inflation fears resurface, the setup is still Goldilocks for small-caps. Particularly as deregulation tailwinds are expected to kick in by late Q3…

Dollar Drama: Dovish Drift Meets Fiscal Fire

The dollar began the week looking punch-drunk, setting fresh local lows as traders leaned into a dovish Fed narrative, ballooning deficits, and signs of political meddling in monetary policy. But by Thursday, the jobs report threw a lifeline. DXY clawed its way back to end the week just a hair lower.

Still, the structural headwinds for the greenback haven’t changed:

Fiscal credibility is fading: The administration is openly embracing a "run it hot" playbook: spend now, hope growth outpaces deficits later.

Overcrowding: The dollar is still a consensus long, vulnerable to position unwinds.

Political pressure on the Fed: Trump’s repeated calls for 1% rates and criticisms of Powell are eroding confidence in central bank independence. The market is already pricing in a more pliable Fed chair in 2025.

Technically, the dollar’s dancing on the edge:

Hanging on by a thread inside a long-term parallel uptrend channel.

Break below, and the 200-month MA (~92) is in sight.

For any upside reversal, DXY needs to reclaim the 97.9 zone, and ultimately, 99.6, a level it failed to hold during the Middle East tension spike.

If weakness persists, the door remains open for a multi-year breakdown. But if we do get a snapback, expect USDJPY to lead, the yen typically underperforms in dollar bounces.

Powell, Bessent, and the Bond Market Chessboard

This week brought more dovish smoke signals from the Fed and Powell himself added a flicker of ambiguity:

“I wouldn’t take any meeting off the table.”

Translation: July rate cuts are not off the menu, a tame inflation print could be the final push toward action.

Then came Treasury Secretary Bessent, who raised eyebrows by echoing Janet Yellen’s once-criticized playbook:

“Why would we borrow longer term at these rates?”

So much for criticizing short-term financing. Bessent now appears fully onboard with the bill-heavy approach, minimizing interest costs today at the expense of rollover risk tomorrow.

The bigger macro context?

The BBB (Build, Borrow, Boom?) bill is passed, pushing deficits higher.

Bessent’s spin: “This bill will set off growth like we’ve never seen before… the bill pays for itself.”

Optimistic? Sure. But the message is clear, the administration is all-in on a growth-led deficit reduction strategy.

Bond market reaction? A familiar dance.

Yields initially dipped on the dovish tone but bounced right back post-NFP.

10Y yield surged back to ~4.35%, erasing gains and reinforcing the rangebound narrative.

Here’s the map:

Short-term range:

Support: 4.25%

Resistance: 4.75%

Macro range (past 3 years):

Support: 3.75%

Resistance: 4.75–5.0%

In short: bonds are still stuck in a behavioral sine wave. Traders are reacting emotionally to every economic print, while the underlying structure remains unbroken.

If we’re going to see a breakout to the upside, it’ll likely require disinflation + Fed cuts. A breakdown? That’s a slower burn, inflation resurgence is the lurking risk into late 2025 or 2026.

Until then, the game is clear: fade the extremes, respect the range.

Crude: Quiet, but Coiled for a Move

Oil prices took a breather last week as geopolitical heat faded, particularly in the Middle East. Still, crude found support, rising alongside other hard assets in what looked more like a sympathy bid than a directional breakout.

Bigger picture?

Not much has changed. Crude remains below the long-term downtrend line traced from the 2022 highs, the recent breakout attempt during Middle East tensions proved a false start. Unless geopolitical tensions reignite, the focus will likely shift back to supply-side dynamics, which could weigh on prices again.

Technicals to watch:

Support: $64, aligns with the May breakout.

Resistance: 200-day moving average / $72 per barrel, needs to be reclaimed for any sustained rally

Long-term floor: Mid-$50s to low-$60s, key levels from 2019 and 2020 that acted as support earlier this year

Gold: The Metal of Political Mistrust

Gold had its feet to the fire last week, testing a support trendline that’s held firm since late 2024. The pullback was driven by fading geopolitical risk, particularly in the Middle East, but once again, gold found its footing.

The real story, though, is structural. Gold’s most important catalyst right now isn’t CPI or jobs data, it’s the perception of Fed independence breaking down.

Trump has repeatedly attacked Powell and is openly hunting for a replacement who will cut rates and submit to White House guidance.

The market sees this for what it is: a move toward politicized monetary policy and gold thrives in that vacuum of trust.

Add to that:

The looming expiration of tariff delays → interim macro uncertainty

Dovish tone from Fed + fiscal expansion → real rates likely stay low

Final Thought:

Markets don’t move on what’s obvious, they move on what’s underpriced. And what’s underpriced right now is the possibility that this cycle extends, not ends.

That growth outpaces debt.

That the Fed doesn’t break things.

And that real upside lies not in consensus trades, but in the forgotten corners where positioning is light and policy winds blow strong.

The week ahead will test that thesis not just with data, but with positioning.

Stay nimble. Stay asymmetric. And don’t fall asleep while the pain-trade sneaks higher.

-BSR

Disclaimer:

Remember, this is not financial advice. You are fully responsible for your own decisions!

The information provided on this website/Substack is for informational purposes only. While it is believed to be reliable, Blackshore Research does not guarantee its completeness or accuracy. This content is not an offer or solicitation to buy any financial instrument. The information and terms on these pages can change without notice. Unauthorized use of Blackshore Research’s websites and systems is strictly prohibited. This includes data scraping, unauthorized access, password misuse, or improper use of posted information. Your eligibility for certain services will be determined by Blackshore Research and its affiliates. Investment services are not FDIC-insured and carry investment risks, including potential loss of principal. The proprietary information from Blackshore Research or third-party providers is for individual use only and must not be redistributed or transferred without prior written consent from Blackshore Research.