Healthcare Update: Adding to the Thesis

An update to our Healthcare Basket + Biotech additions

Over the past ten months, the healthcare and biotech sectors have been a battleground of volatility driven by political tremors, shifting policy landscapes, and macroeconomic instability.

RFK and the growing MAHA movement have only added fuel to the fire. But with disruption comes opportunity, and we believe this chaotic backdrop has created some of the most compelling setups in years.

Healthcare policy is uniquely susceptible to headline distortion, where perception often outruns reality. But this isn’t a bug… it’s a feature for active investors.

“Politics introduces bias, bias creates dislocation, and dislocation is where alpha is born.”

- BSR

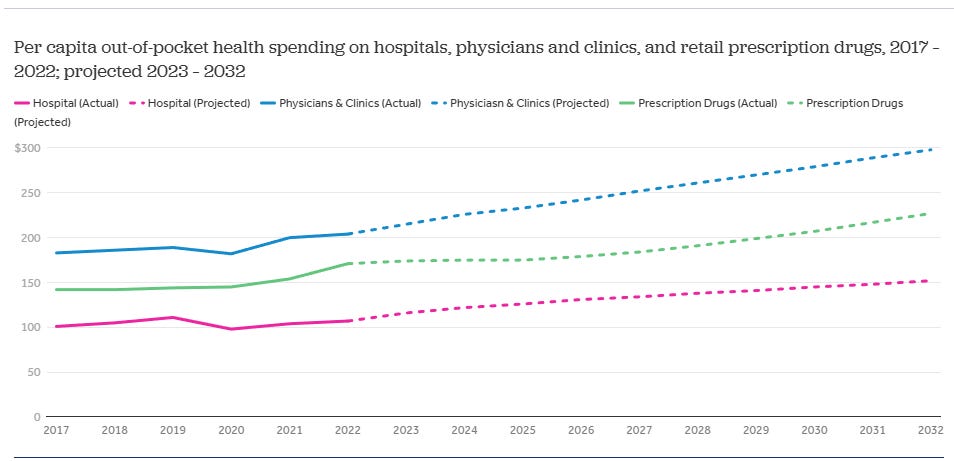

Policy chatter has been loud, but mostly off-key. Washington’s latest rule changes landed with the usual fireworks, yet national health-spending is still projected to grow 5 %+ into 2025, hardly the apocalypse the headlines suggest.

So instead of trading on tweets, we follow the cash flows. Each supposedly “toxic” narrative (drug-pricing reform, election-year brinkmanship, even the AI-doctor hype cycle) contains a seam of opportunity once you strip away the fear-premium. Several of our top performers were born precisely where consensus shouted “avoid.”

And to sum it all up, we take a look at a mispriced sub-sector that looks, to me, like biotech circa 2012…

Volatile on the surface, but compounding for those willing to stomach the drama.