Before we dive in… A new trade set up has been published in the Tactical Trades section…

You can find it here:

Lastly, two thematic primers are in the works with one close to completion related to agentic a.i. You can find a warm up article here:

Now let’s dive in!

Looking Back at the Past Week

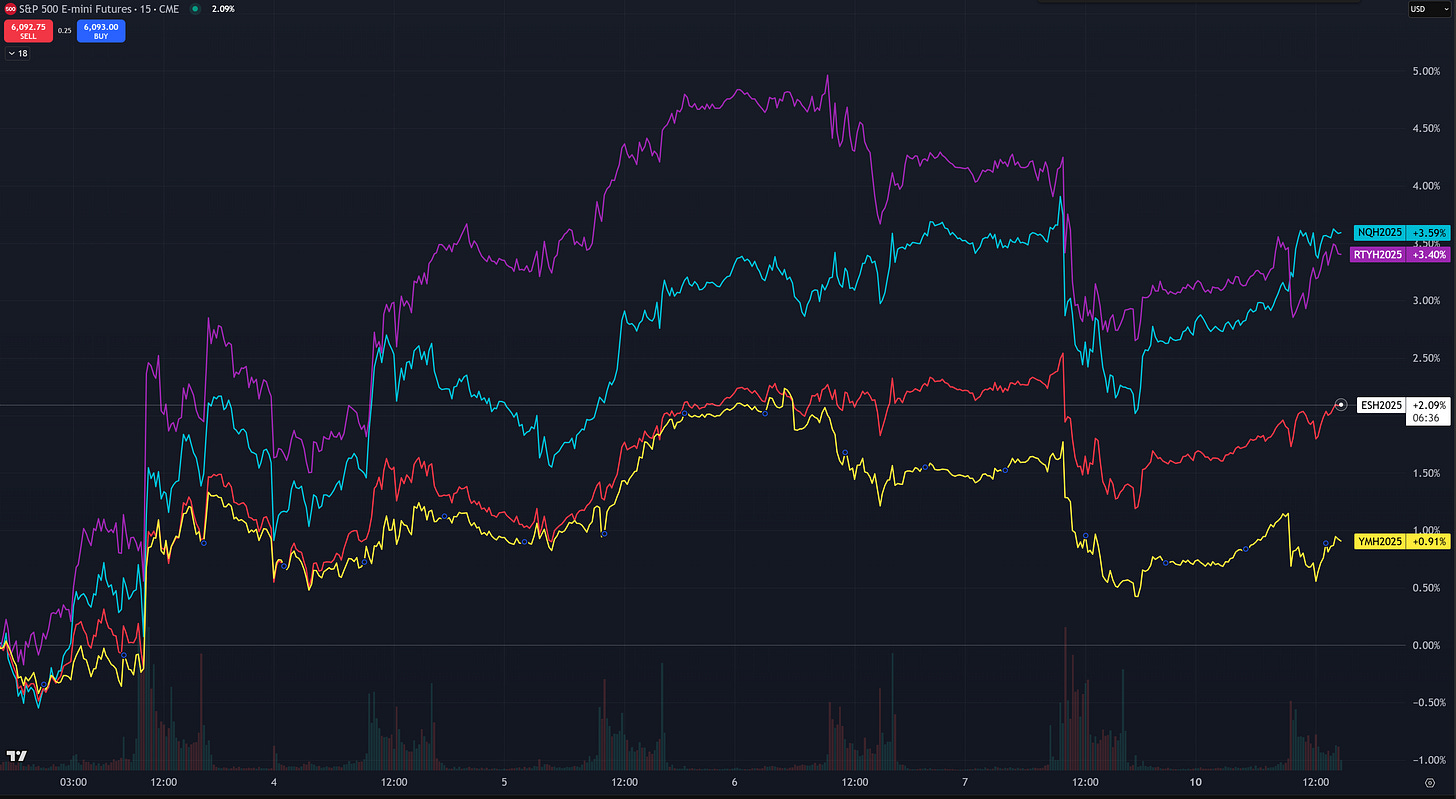

This past week began with a burst of Monday volatility. Yet again, any initial dip was quickly bought, reinforcing the recent pattern that sellers struggle to find consistent follow-through to the downside. However, by the end of the week, we saw a sharp reversal spurred by two key developments: a rise in inflation expectations and another Friday tariff-related headline. Consequently, the major indices gave back much of the progress they’d made after Monday’s lows. In the end, most indices finished the week essentially flat or slightly down, with the NASDAQ 100, emerging as the strongest performer, while the Dow lagged behind.

Key Economic Data Ahead

Looking forward, the spotlight this week will be on Federal Reserve Chair Powell’s testimony on Tuesday and Wednesday, as well as several crucial data releases: Consumer Price Index (CPI), Producer Price Index (PPI), and Retail Sales. The Fed has emphasized that if inflation resumes a downtrend—proving the recent uptick to be just a “blip”—they would be open to resuming rate cuts. However, they remain cautious until they see clear evidence of inflation trending lower. Given that the next FOMC meeting won’t occur until March, these incoming data points carry extra importance.

Keep reading with a 7-day free trial

Subscribe to Blackshore’s Substack to keep reading this post and get 7 days of free access to the full post archives.