Weekly Briefing: Red-Hot Rally, Cold Feet Ahead?

Weekly Roadmap for 05/04/25-05/10/2025

A Market on a Mission

It was a week packed with noise, but the market had other plans…

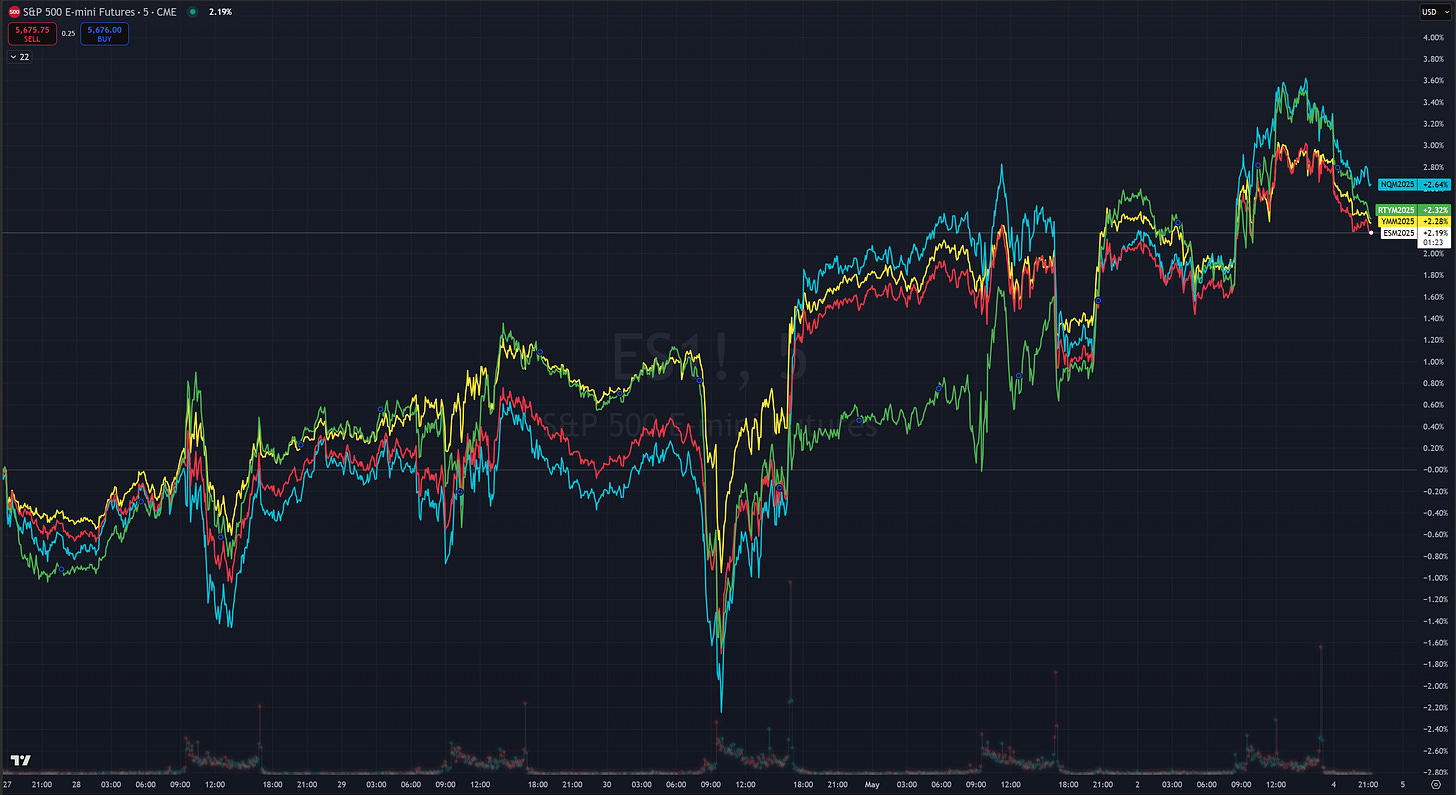

Mid-week jitters over a weak GDP print sent indices down… only for stocks to reverse and close green by day’s end. Then came Microsoft’s blowout earnings, which sent the S&P on an extended rally, culminating in a 9-day win streak, something we haven’t seen in over 20 years.

While the Nasdaq (QQQ) led the charge, thanks to a Mag-7 melt-up, the S&P 500 (SPX) despite being the worst performing major index still finished up just over 2.9% on the week. That says a lot about the strength of this move.

Why This Rally Isn’t a Surprise

We’ve been flagging for weeks that:

Positioning was historically light

Hedge funds were underweight (UW) equities

The 90-day tariff delay and softer China rhetoric would spark a chase

That’s exactly what happened. This rally has become a classic pain trade, with underexposed funds forced to chase strength. Microsoft’s results only added fuel to the fire, especially with Mag-7 positioning near multi-year lows.

On the Docket: FOMC + China

The biggest event on deck? FOMC Wednesday.

The Fed is expected to hold rates steady

Markets are pricing in 3 cuts for 2025, starting in July

The key debate:

→ Will Powell double down on tariff-induced inflation persistence?

→ Or call it a one-time price shock?

Last time Powell spoke, his tone was hawkish. But since then:

PCE data dropped off sharply

Hard data held up better than expected

Inflation is drifting toward the Fed’s target

Still, the real effects of uncertainty-driven policy shocks may not fully show up until later this summer.