Markets wrapped up last week in relatively calm fashion, despite a major event on the calendar: the FOMC meeting. The action stayed mostly contained, with equities trading in tight ranges. The Dow and the Nasdaq 100 (Q’s) were the relative outperformers, though that’s a generous take. The Dow finished flat, while the Q’s ended down 0.67%. Small caps took the brunt of the weakness, falling 0.85% on the week, only to rebound up 3.5% by today’s open…

What’s on Deck This Week?

The spotlight this week is on Friday’s PCE inflation report — the Fed’s preferred inflation gauge. Markets are bracing for headline PCE to hold steady at 2.5% YoY, while Core PCE is expected to tick up to 2.7% from 2.6% the prior month.

Aside from that, investors will be sifting through a mix of economic data: PMIs, jobless claims, GDP revisions, and a handful of smaller data points scattered across the week. In short, this week won’t be light on catalysts — even if it’s not all fireworks.

A Quick Recap: Last Week’s Highlights

While headlines were few and far between, we did get one surprise out of D.C. late in the week:

Trump: "There will be flexibility on tariffs. Basically, it’s reciprocal."

That’s a noticeable softening in tone ahead of the much-discussed April 2nd “Liberation Day”, when the U.S. is expected to enact reciprocal tariffs. Trump’s comments leave room for negotiation and suggest the administration isn’t looking to escalate — at least not yet. If the market’s biggest fear is uncertainty, this gave a hint of potential clarity.

Economically, last Monday’s retail sales report came in slightly below expectations — but one important component, the control group, jumped by 100bps, which feeds directly into GDP. That datapoint was a quiet positive.

And then, of course, we had the FOMC meeting.

No shockers on the rate front: the Fed kept its outlook at two cuts for 2025, resisting earlier speculation that a third might sneak in. The more notable surprise came in the balance sheet: Quantitative Tightening (QT) was dialed back from $25B to just $5B, signaling a near-pause.

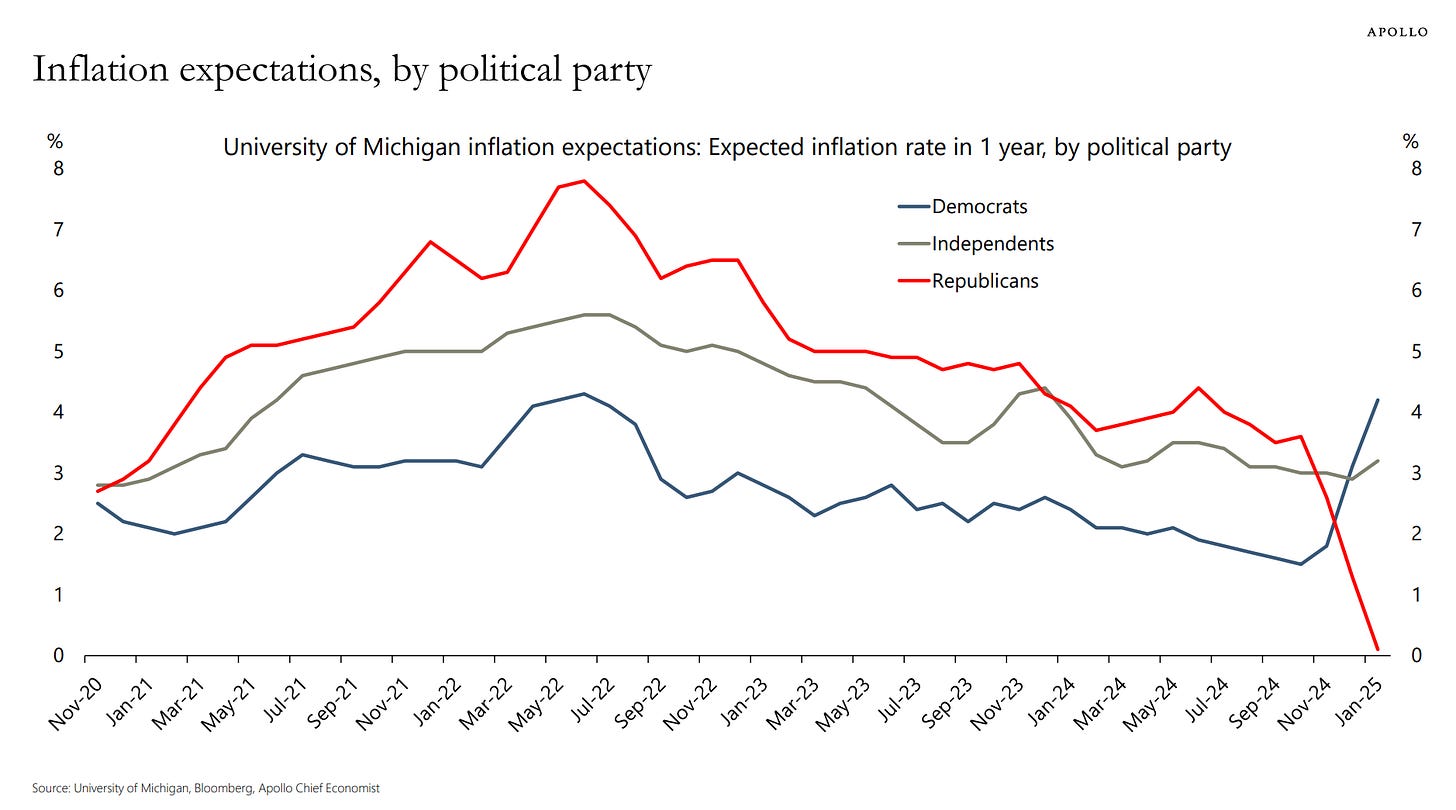

Chair Powell played a dovish hand, contrasting slightly with a FOMC statement and dot plot that leaned mildly hawkish. The Fed revised growth expectations lower, nudged inflation projections up slightly, and cited tariffs as a growing uncertainty. Despite that, Powell doubled down on long-term inflation expectations being “well-anchored.”

He also took direct aim at the recent UMich survey, which showed a spike in 1-year inflation expectations. Powell dismissed it as an outlier, highlighting how disconnected survey-based expectations have become from actual data. A subtle but important signal: the Fed is still trusting the data over the noise.

Eyes Back on PCE and Tariff Clarity

With the Fed in the rearview, all eyes turn to Friday’s PCE report. As mentioned earlier, expectations are for headline PCE to hold steady at 2.5%, while core edges up to 2.7%. Recent CPI and PPI prints came in hot — and since components of those reports bleed into PCE, expectations have already been revised higher.

Meanwhile, “Liberation Day” looms. With Trump now signaling flexibility on tariffs, markets are starting to game out a best-case scenario: if tensions ease and policy clarity emerges, equities could catch a tailwind.

SPX Technicals: Bear-Gap Battle Continues