Hello Everyone,

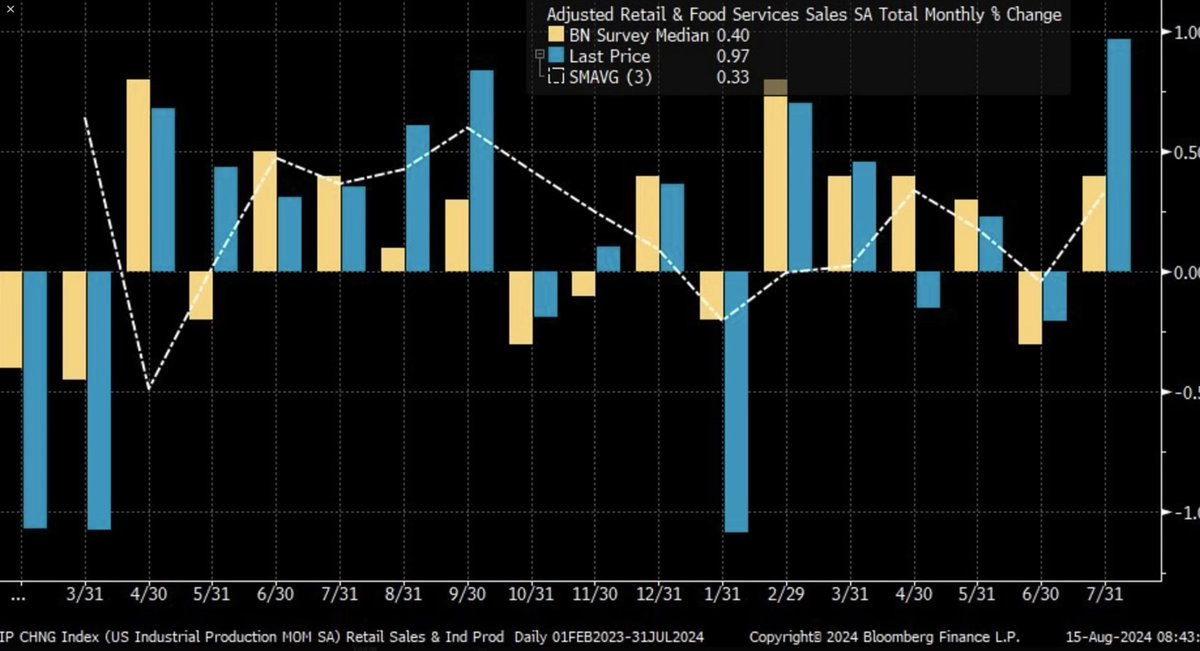

Last week was eventful in the markets, as fears of a growth slowdown began to ease. A notable highlight was Thursday’s better-than-expected Jobless Claims report, coupled with a strong performance in Retail Sales, both contributing to what some are calling "goldilocks" conditions.

Jobless Claims came in at 227,000, a significant improvement from the previous week's 250,000, helping to alleviate some of the recent concerns about economic growth. Retail Sales also surprised to the upside, adding to the optimism, despite a downward revision for the previous month. The market, as always, is forward-looking, with a keen focus on current and future growth rather than past data.

The carry trade saw renewed momentum last week, with USD/JPY nearly touching 150 after dipping close to 140 earlier this month. This is a market that continues to adjust and fade extremes, reflecting ongoing shifts in investor sentiment.

In general, the indices rallied last week as growth fears receded and disinflation—not deflation—continued, reinforcing the soft-landing narrative. Just two weeks ago, concerns about a recession were top of mind, triggering market deleveraging. Yet, the market has quickly shifted, once again swinging the pendulum as narratives evolve.

The substantial beat in Retail Sales and the better-than-expected Jobless Claims report have flipped the script. The economic slowdown and recession talk may soon pivot back to inflation concerns, especially if the Fed cuts rates into a growth rebound with improving data. However, lingering fears still persist.

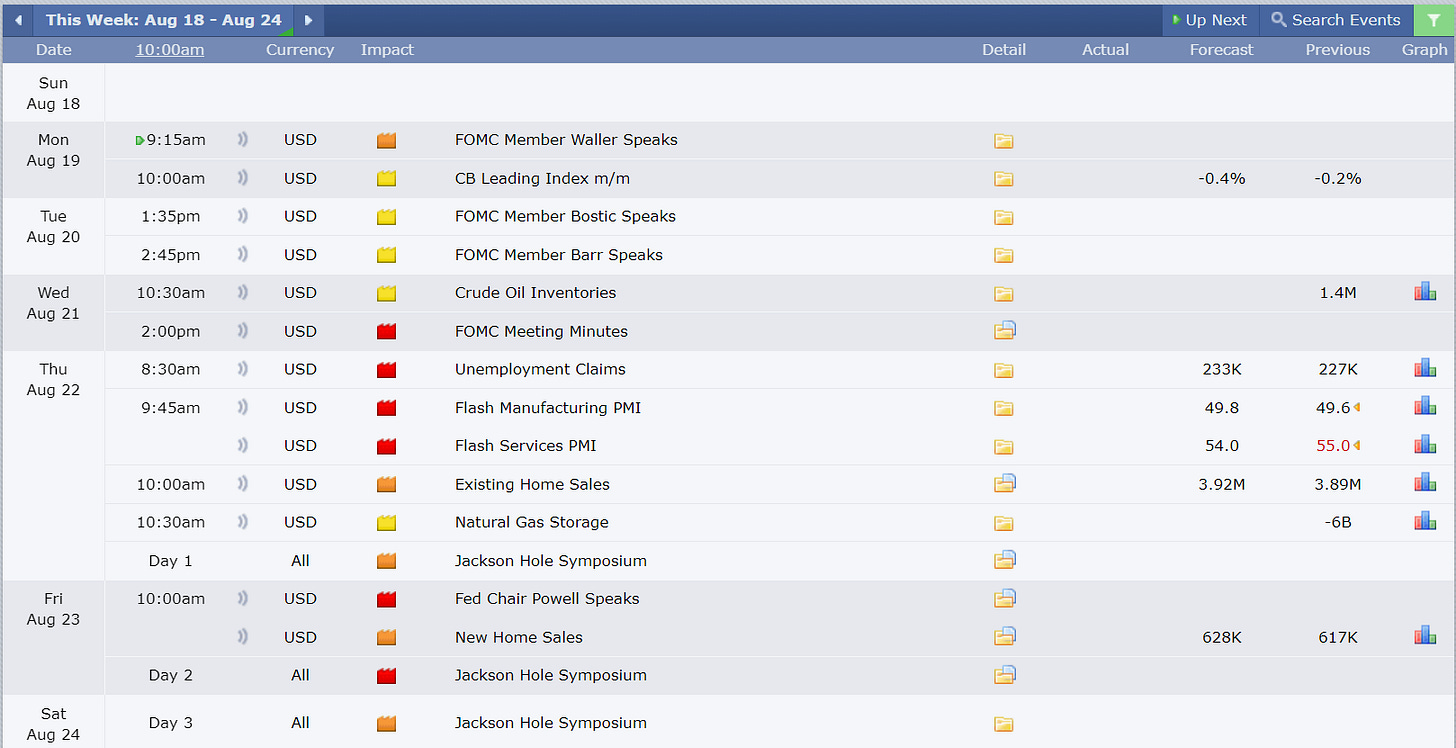

This week features the Jackson Hole symposium, with a relatively light data schedule. We’ll hear from a few Fed speakers, and smaller economic indicators—now more significant as job data has become the new CPI—will be in focus. Fed Chair Powell is expected to speak on Friday, with the market keenly watching for any hints about the future. The key for the markets will be to sustain the soft landing narrative, with inflation data not coming in too soft to stoke deflation or slowdown fears, and job data not too weak to reignite recession concerns.

Economic Data for the Coming Week

As we look ahead, it's relatively quiet on the economic data front, aside from the highly anticipated Jackson Hole symposium. For those who follow these events closely, it's a key moment.

The week will feature a mix of Fed speakers and the release of the FOMC minutes on Wednesday. While the economic data scheduled is generally considered minor, these reports have taken on greater significance recently, given the market's ongoing concerns about growth.

As for Powell’s upcoming speech, the market is pricing in a 100% certainty of a rate cut in September, though there is still speculation about whether it will be a 25 or 50 basis point cut. While Powell acknowledged the possibility of rate cuts during the last FOMC meeting, he didn’t provide a clear signal. At Jackson Hole, we may see him express more confidence in a 25 basis point cut as inflation continues to moderate and the mixed economic data rolls in. A 50 basis point cut seems unlikely, as it could signal underlying issues and negatively impact the markets. Therefore, it’s expected that the Fed will opt for a 25 basis point cut in September, sticking to a predictable path to avoid surprising the markets.