Quick Notes: U.S. Economic Outlook

Macro Memo: Key Insights and Market Implications

The U.S. economy has shown resilience against recessionary pressures, with recent data indicating continued growth momentum. As we move toward the year-end, various economic and market indicators are shaping investor sentiment and influencing market behavior. Here’s a breakdown of key insights across GDP growth, corporate earnings, monetary policy expectations, and evolving asset trends.

Resilient Growth and Recession Outlook: A Balancing Act

Recent adjustments to the GDPNow forecast project a 3.4% growth for Q3, fueled by stronger-than-expected retail sales and declining jobless claims. This reflects an economy gaining momentum even before anticipated rate cuts, with a potential 75 basis points cut forecasted into 2025. Such cuts would significantly enhance liquidity, adding a robust tailwind to growth.

Despite these growth indicators, there remains a stark divide across income classes, a byproduct of Federal Reserve policy impacts. Recent policy adjustments aim to address this imbalance by creating more inclusive growth opportunities for middle and lower-income segments. In this context, a “no-landing” scenario appears increasingly likely. As budget deficits remain high, and liquidity increases sustain economic activity, the economy may continue on this growth trajectory for several more quarters, even years, without even anything close to a recession manifesting.

Market Sentiment, Earnings, and Pro-Growth Policies

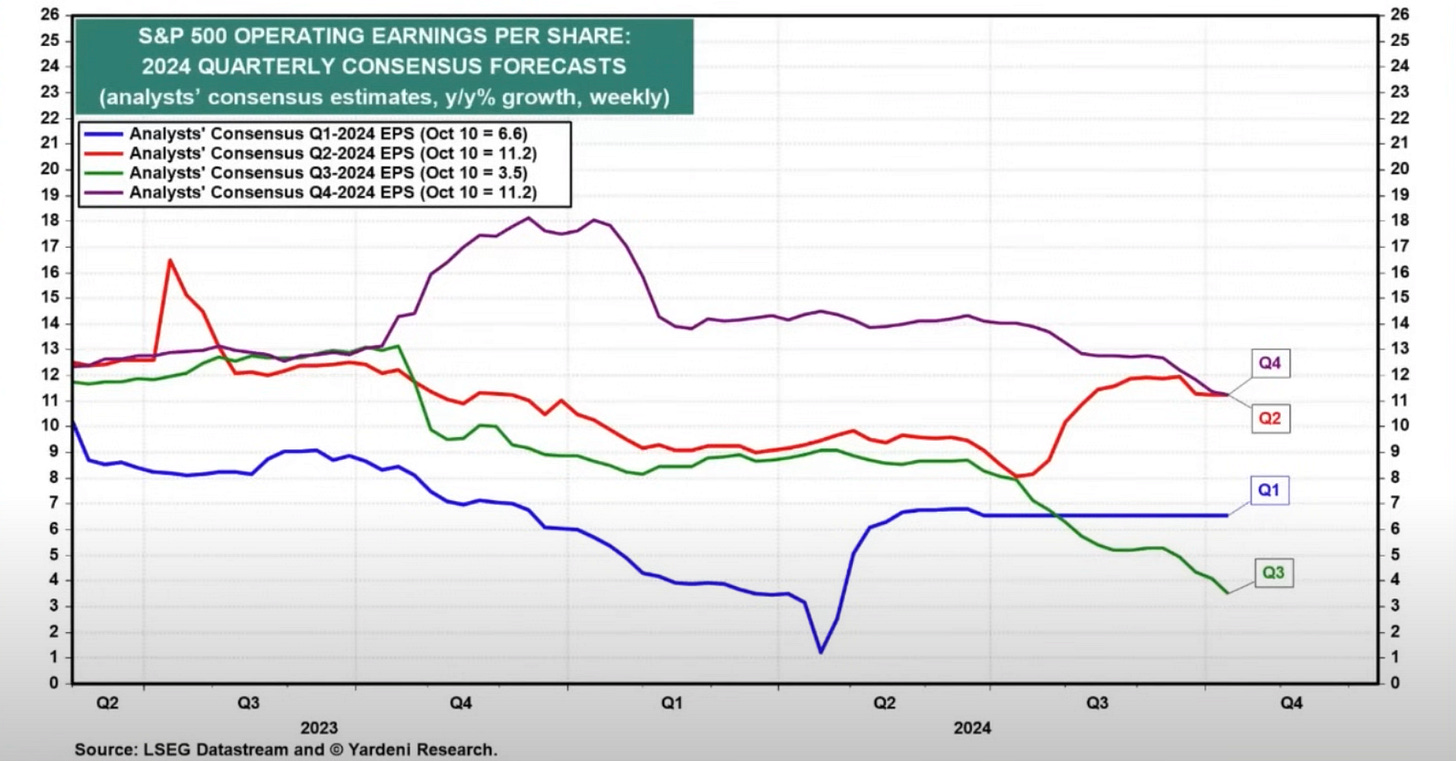

Global growth expectations are rising at the fastest rate since May 2020, reflecting a strong sentiment that could bolster investor confidence. Wall Street’s conservative earnings forecasts appear strategic, potentially setting up a favorable environment for earnings surprises.

While bears cite rising yields as a cautionary signal, the tight spreads in U.S. investment-grade corporate bonds—a level not seen since 2005—suggest an alternative perspective: yields can rise due to growth, not solely inflationary concerns.

Meanwhile, pro-growth policies, including increased oil drilling and regulatory easing, provide additional tailwinds. These structural growth drivers could benefit the economy in the long term, despite certain inflationary risks, such as reduced immigration and heightened tariffs. Regardless of election outcomes, both major U.S. candidates’ policies are expected to support growth through populist strategies and deficit spending. Post-election, volatility could diminish substantially, creating favorable conditions for equities, especially with the largest corporate buybacks happening in the final two months of the year.

Geopolitical Dynamics and Market Liquidity

The energy sector faces significant shifts in response to U.S. oil policy and OPEC’s stance. Former President Trump's advocacy for U.S.-driven oil production may place substantial pressure on OPEC to maintain its pricing power, which could unleash disinflationary effects. This could counterbalance fiscal spending pressures and, if coupled with improvements in government efficiency, introduce liquidity across various sectors.

Additionally, the currency market is showing supportive signs for liquidity, with a stronger yen and weaker dollar benefiting liquidity-sensitive equities. Historically, these currency shifts have aligned with outperformance in small- and mid-cap stocks, particularly in the seasonal strength of November. Together, these geopolitical and currency-driven trends could provide a meaningful liquidity boost to U.S. markets, favoring smaller-cap stocks in particular.

Alternative Assets and Currency Outlook

The potential adoption of Bitcoin (BTC) as a balance sheet asset raises intriguing questions. Companies like MicroStrategy, which issue convertible debt to acquire BTC, exemplify this trend. BTC’s potential yield generation, especially with upcoming ETF options markets, could make it a strategic alternative to low-yielding treasuries, offering a hedge against long-term deficit-driven inflation.

At the same time, the dollar’s recent strength appears to be stabilizing as rate-cut expectations moderate. With fewer cuts now priced in, the dollar aligns more closely with fundamentals and shows a downside bias. A 25 basis point cut in November could align with a strong economy, decoupling the dollar from bond yields and allowing emerging markets and small-cap trades to thrive in this increasingly balanced rate environment.

Mid-Cap Opportunities in a Shifting Landscape

Looking ahead, mid-cap stocks (market cap $2B-$50B) present attractive investment opportunities. With rate cuts likely and liquidity tailwinds favoring smaller companies, mid-caps are well-positioned to outperform larger peers. This sector’s exposure to easing rates and favorable earnings setups makes it a compelling choice for investors seeking growth as market dynamics evolve.

These are all things I’ve been thinking about as we come into the end of the year. Post election I will be monitoring things very closely and plan on issuing updates and 2025 forecasts later on this month.

-BSR

Disclaimer:

Remember, this is not financial advice. You are fully responsible for your own decisions!

The information provided on this website/Substack is for informational purposes only. While it is believed to be reliable, Blackshore Research does not guarantee its completeness or accuracy. This content is not an offer or solicitation to buy any financial instrument. The information and terms on these pages can change without notice. Unauthorized use of Blackshore Research’s websites and systems is strictly prohibited. This includes data scraping, unauthorized access, password misuse, or improper use of posted information. Your eligibility for certain services will be determined by Blackshore Research and its affiliates. Investment services are not FDIC-insured and carry investment risks, including potential loss of principal. The proprietary information from Blackshore Research or third-party providers is for individual use only and must not be redistributed or transferred without prior written consent from Blackshore Research.