Q1 Performance Review + Commentary

BSR Quarterly Review, Commentary, and Updates...

Lifetime Performance vs. S&P 500

Before reading I encourage you to take a look at our current holdings (as of 03/31/2025) which you can find under the “Current Holdings” tab at:

There is also a link at the end of this article if you make it that far ;)

Vindication, Volatility, and What Comes Next

Well, well, well. After a perfectly respectable stint of looking completely wrong, our bearish call for the first half of 2025 has landed right on target. SPX 5600—tagged. Chalk one up for patience, conviction, and a willingness to be early (which, as you know, often just feels like being stupid… until it doesn’t).

But price targets aside, thematically, things are getting interesting. For months—no, years—AI has been the black hole sucking up all the oxygen in thematic equity. And within AI, the U.S. has been the sun around which everything orbited. But tides are shifting. Volatility cracks open the surface, and through it we’re starting to see fresh, weird, beautiful themes bubbling up—especially in the Rest of World versus U.S. dynamic.

U.S. equities have suddenly leapt toward pricing in a recession. Bonds? Still lounging poolside, unbothered. This kind of asset class schizophrenia usually doesn’t last long, but it’s telling. It signals confusion. And confusion, for us, is fertile ground.

So, what now?

We’re using this moment to recalibrate and share an updated snapshot across our active thematic coverage and watchlists. The U.S. economy, in our view, isn’t falling apart—it’s just trying to find its footing in the fog of policy misfires and political drama. Our stance? Cautious. Alert. Ready. A “wait-and-see” posture, but not asleep at the wheel. There are macro risks worth monitoring—and opportunities that only show up when the world gets weird.

I. Executive Summary

Timeframe: January 1, 2025 – March 31, 2025

Core Portfolio Return: 22.14%

Benchmark Comparison: S&P 500 (-5.19%)

Key Highlights:

Top Performer: Healthcare/Med-Tech — up 18.75%%

Worst Performer: Ai (aka high beta tech) — down 7.10%

Portfolio Skew: Aggressively hedged

II. Basket Performance

This review is part performance check-in, part reflection. We’re looking at both lifetime performance since inception (November 10, 2023) and how things have evolved more recently, especially over the past quarter. It’s been a wild ride, but the goal here isn’t celebration—it’s calibration.

Let’s start with the obvious: performance has been strong. Since launch, the BSR Core Portfolio has outpaced the S&P 500 by roughly 4x. That’s not a chest-thump—it’s a byproduct of being early on the right themes, staying nimble, and knowing when to hit the brakes.

Take our networks and infrastructure basket, for example. It’s gotten smaller and leaner since August—and that’s been a good thing. The reduction isn’t due to dead weight, but rather a series of exits from positions that worked. We trimmed strength, took gains, and let winners rotate off the board. Sometimes less is more, especially when it means locking in success and freeing up room for future plays.

Below you will find both the lifetime and Q1 performance of each basket…

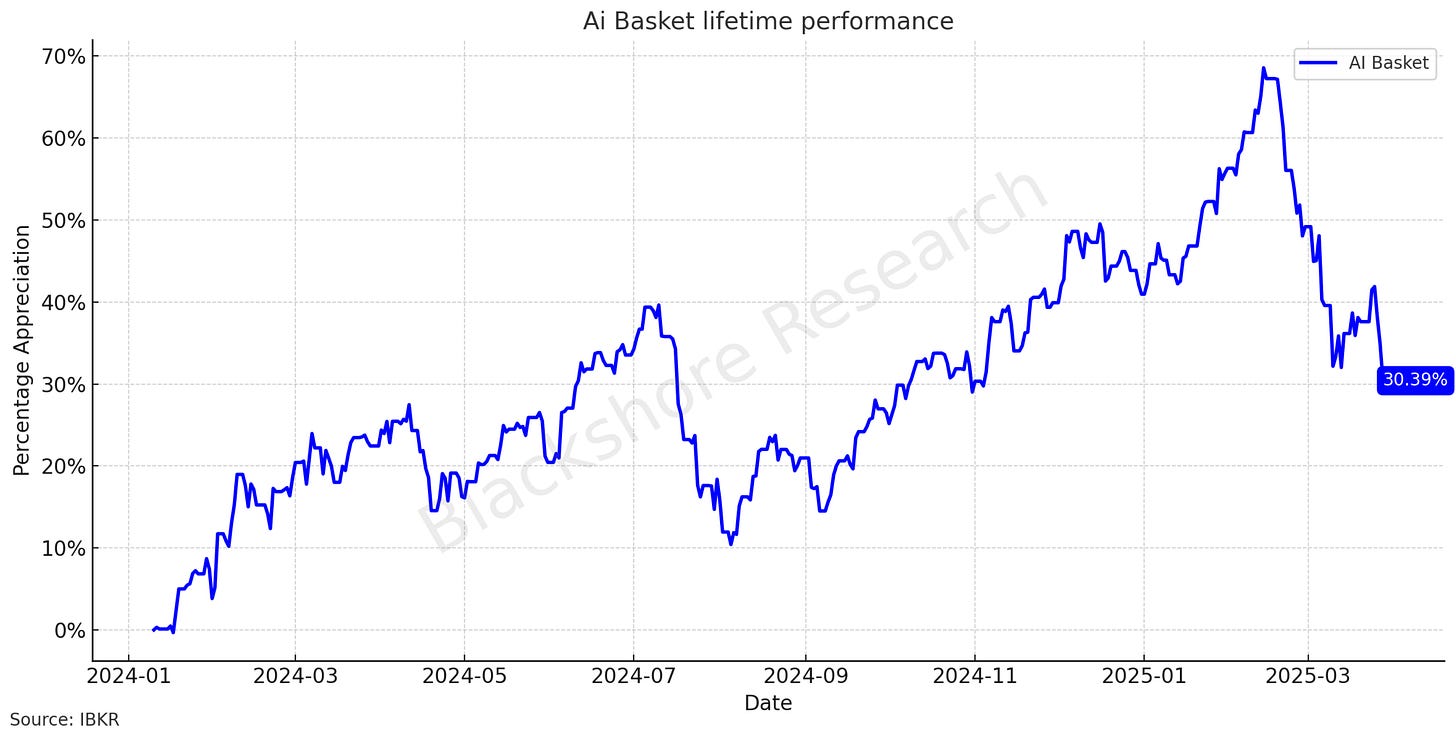

Artificial Intelligence Basket

Lifetime Performance: +30.39%

Q1 performance: -7.10%

Healthcare / Med-tech Basket

Lifetime Performance: +35.76%

Q1 Performance: +18.75%

Networks Infrastructure Basket

Lifetime Performance: +36.60%

Q1 Performance: -0.80%

III. The Turn: Hedging and Taking Chips Off

Right after the inauguration, we made a conscious shift. If you’ve been reading along, you’ll remember we started taking chips off the table.

Link here:

Growth and innovation had a massive run, and it felt like the market was starting to front-run uncertainty.

So we rebalanced. We added TLT, built up our cash, and hedged core exposure with SPX and QQQ puts. It wasn’t about fear—it was about protecting gains and staying mentally flexible in a policy-driven tape. In hindsight, that move helped create stability during what’s become a more uneven stretch for markets.

Hedging Activity: +52.92%

As outlined in our recent Market commentary we monetized our initial SPX puts and rolled into further OTM puts in SPX and QQQ while increasing out TLT holdings to 21.17%

IV. Trade Commentary & Insights

Coming into last year, our plan was to lean into high-beta tech and growth, particularly in sectors like healthcare and infrastructure, which aligned with our broader thematic frameworks. And for the first stretch of 2024, that worked well. These were the "places to be"—until they weren't.

We began advising a gradual unwind of those positions shortly after the election. Not because we abandoned the AI or innovation thesis—it’s still intact—but because momentum began to wane, and macro uncertainty started creeping in from the edges. It made sense to de-risk and get liquid.

As of now, we’re in a wait-and-see posture. That’s not code for paralysis—it’s intentional. We’re sitting on cash, still holding our TLT exposure, and keeping hedges in place. The monthly candle structure suggests downside risk remains, and breadth indicators—like the percentage of stocks above their 200-day—still have room to deteriorate if selling picks up again.

So for now, we keep it simple. Take profits where it makes sense. Hold cash. Stay hedged. That approach has served us well—not because we’re trying to outsmart the market at every turn, but because we’re focused on managing risk, staying curious, and preparing for what comes next.

V. Top Gainers

TSM - Taiwan Semiconductor Manufacturing Co. (Ai) +63.38%

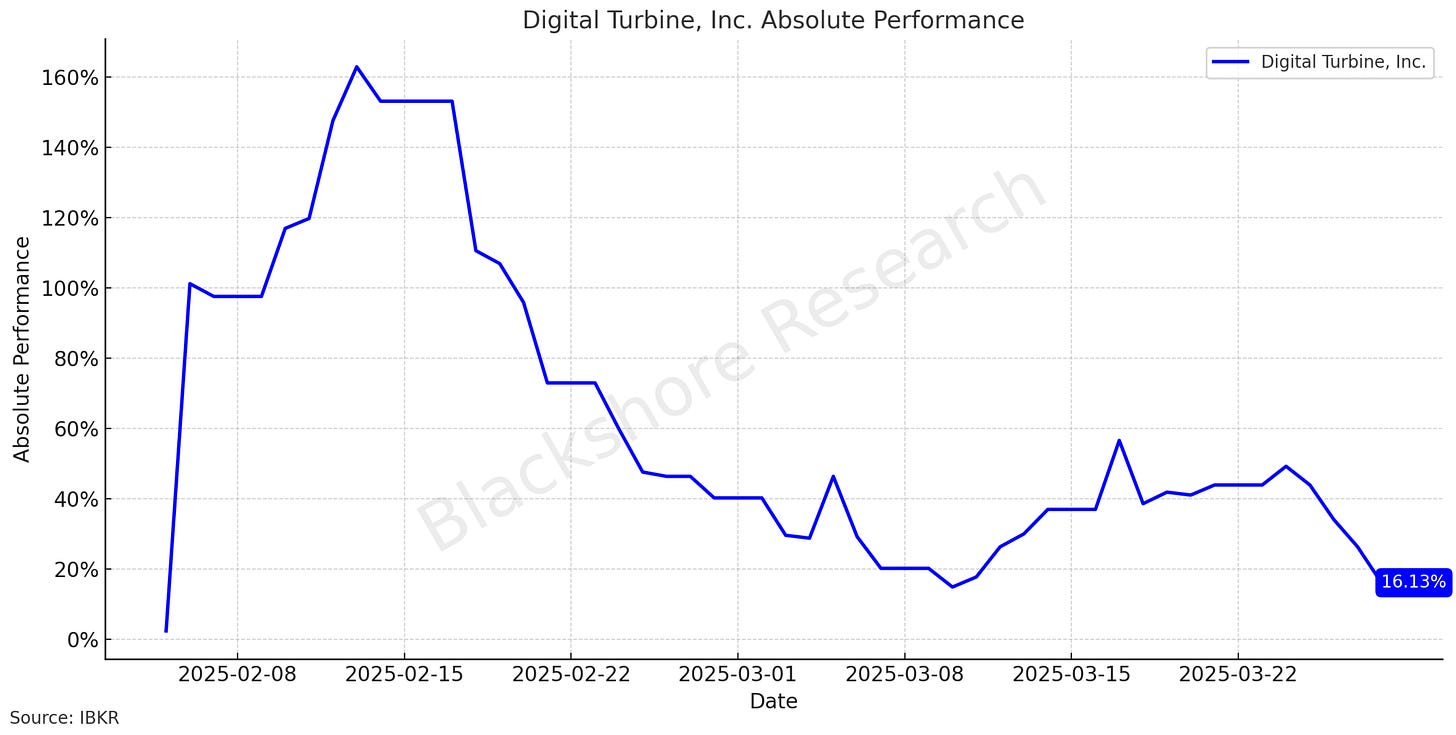

APPS - Digital Turbine (Ai) +16.13% (Should’ve taken more profit…)

NET - Cloudflare (Ai) +42.57%

UI - Ubiquiti (Networks/Infra) +93.24%

SMTC - Semtech (Networks/Infra) +94.00%

LITE - Lumentum (Networks/Infra) +117.40%

STIM - Neuronetics (HC/Med-Tech) +104.81% (Trade is still open, one of my highest conviction longs…)

HIMS - Hims & Hers Health (HC/Med-Tech) +246.10%

GRAL - GRAIL (HC/Med-Tech) +207.67%

VI. Looking Ahead…

As we move forward, the focus remains on staying patient, hedged, and opportunistic. We’re not forcing trades—we’re preparing for the next leg of thematic rotation. A few things to keep on your radar:

We’re entering what I call “AI Phase 3”, where the hype gives way to real enterprise adoption and second-order effects.

I’m also deep into a new energy thesis that ties together policy, electrification, and commodity dislocations.

And finally, keep an eye out for a developing framework around space and military defense stocks—a corner of the market that’s quietly aligning with some of the biggest geopolitical currents we’ve seen in years.

Check out our current holdings below…

Stay tuned. More soon.

-BSR

VII. Current Portfolio Holdings (as of March 31)

Keep reading with a 7-day free trial

Subscribe to Blackshore’s Substack to keep reading this post and get 7 days of free access to the full post archives.