Hello Everyone,

I hope you're all enjoying the weekend and managing to take a break from your screens.

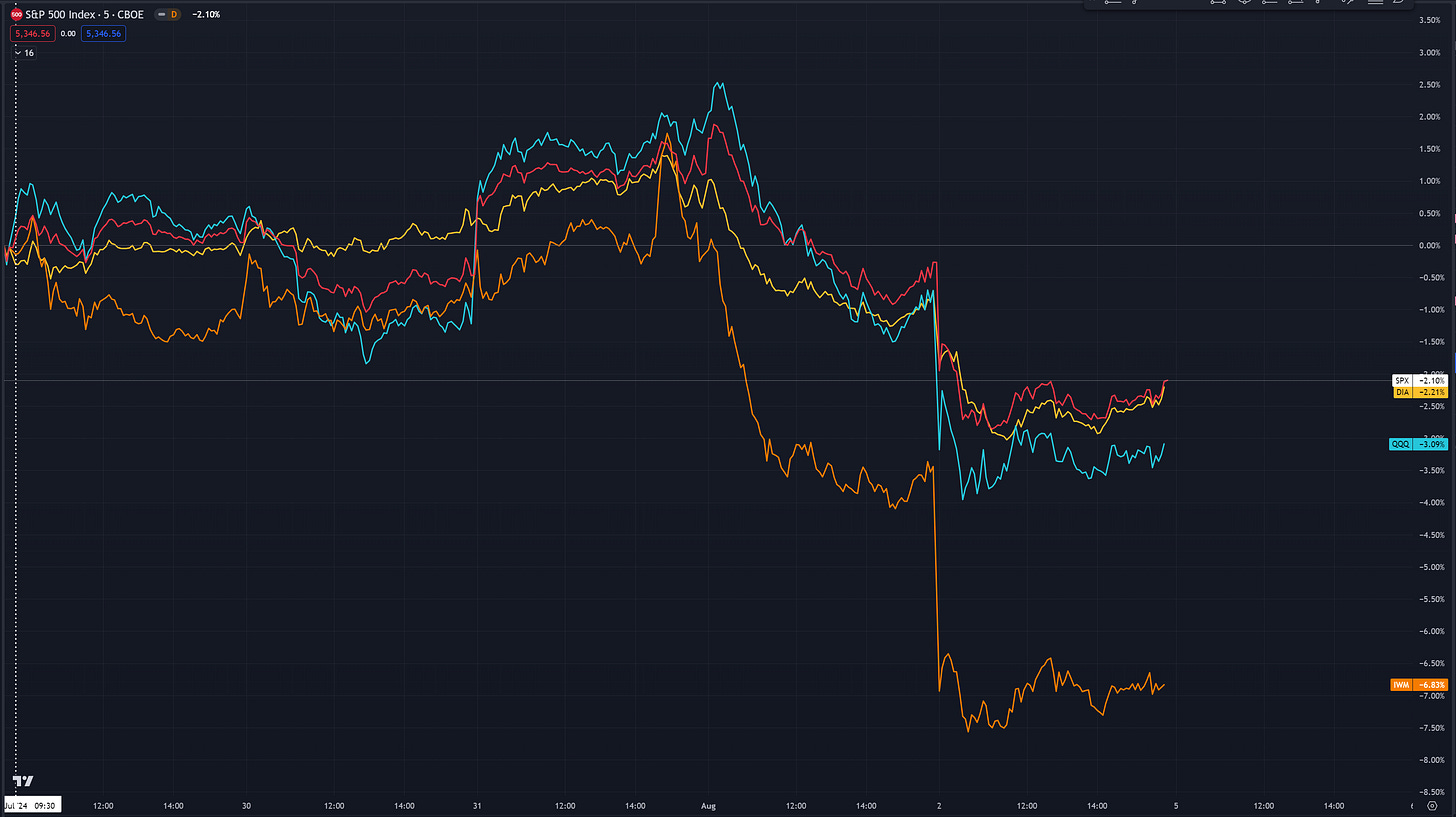

This past week was quite eventful in the markets. Early in the week, we witnessed a significant drop in tech stocks, hitting what seemed like a low point. This dip contributed to the Nasdaq's most substantial gain of the year, jumping nearly 4%. However, as the week went on, the mood shifted. A lower-than-expected ISM Employment Index sparked fears of slowing growth, reversing much of Wednesday's gains. The situation worsened on Friday with a disappointing jobs report and a rise in the unemployment rate from 4.1% to 4.3%, prompting concerns that a recession could be around the corner.

Next week looks to be less hectic in terms of economic events. We have several key data points to look out for:

the 10-year and 30-year bond auctions

PMIs

ISM Manufacturing Index

Jobless claims

Crude oil inventories.

Given the recent concerns about slowing growth, these indicators are especially significant. If the data comes in weak, it could further support the "growth scare" narrative and keep market volatility high. On the other hand, stronger-than-expected results could help calm market fears and reduce volatility.