Hello everyone,

As we move further into 2024, it's clear that this year has been full of momentum, and the remainder promises to be just as dynamic. I want to express my gratitude for your continued support and enthusiasm. Here’s to a healthy and prosperous second half of the year! Now, let’s dive into what lies ahead this week.

Reflecting on last week, we finally witnessed the much-anticipated Powell Pivot, with a 25 basis point rate cut firmly on the table for September. Powell confidently navigated the past week's developments, and now the market's focus shifts to the September Jobs report. Given the recent uptick in the unemployment rate (UER), this report could either reinforce the narrative of a soft landing or, if the UER stabilizes or declines, further solidify that outlook.

However, a key consideration for the Fed is the potential rebound in economic data. Should the September Jobs report surprise to the upside, quelling fears of a recession, the Fed might find itself cutting rates amid an economic resurgence. This scenario could shift concerns from recession to inflation risks, particularly as core inflation appears to be bottoming out. Such a shift in market sentiment could be swift and dramatic.

In the backdrop, we’re seeing a complex interplay of factors, including the Bank of Japan’s potential rate hikes, the unwinding of carry trades, ongoing growth slowdowns, and recession fears. Despite all this turbulence—including the short Vol trade blowing up—all major indices have turned positive month-to-date, a notable recovery from the 700bps+ declines we saw in early August.

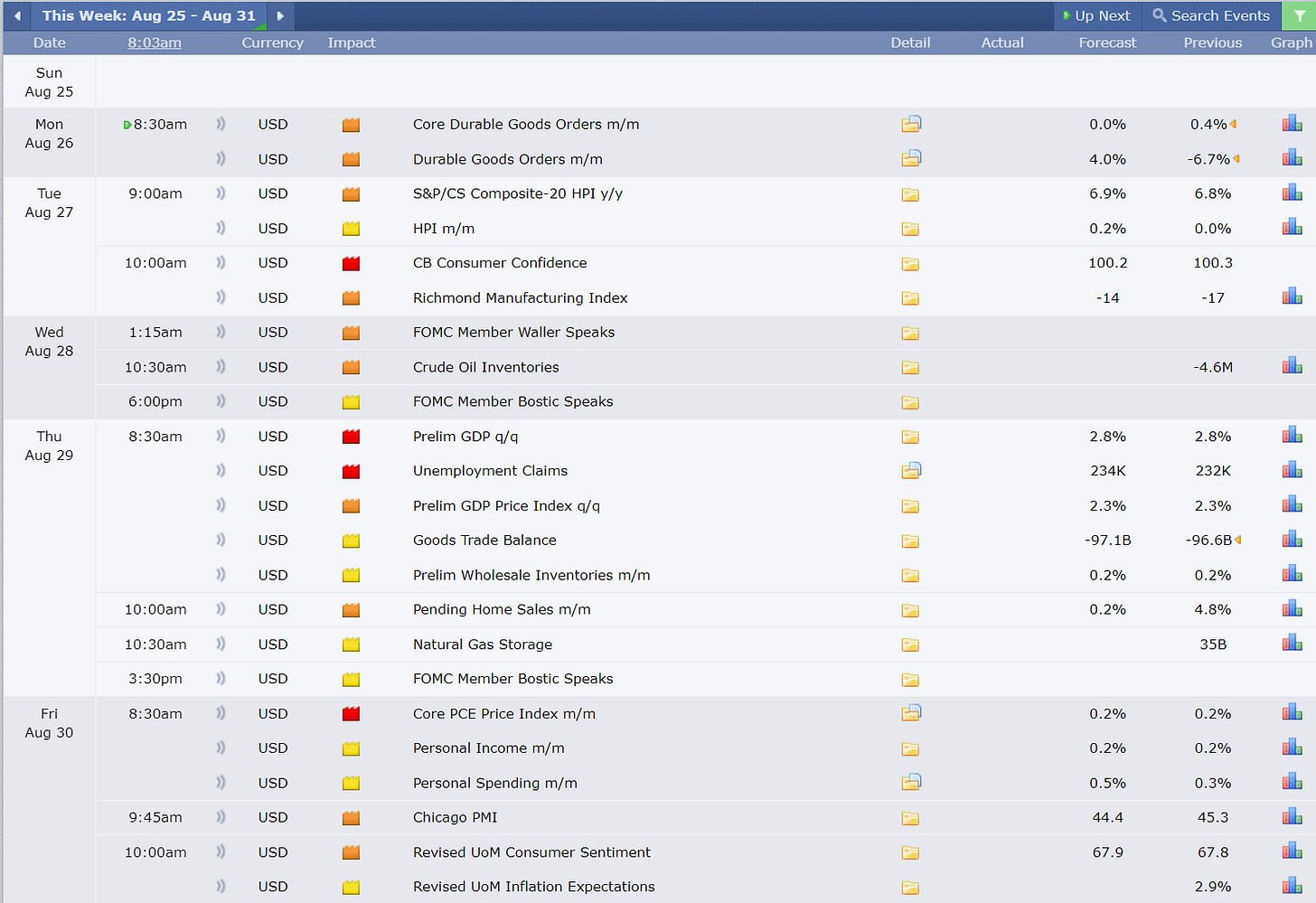

Economic Data for the Coming Week:

Looking ahead, this week is relatively light on economic data. The key points to watch are Thursday’s Q2 GDP figures and Jobless Claims, along with Friday’s PCE numbers. While the market remains more concerned with growth and the labor market than inflation at the moment, a report that is too soft could be interpreted negatively.

Keep reading with a 7-day free trial

Subscribe to Blackshore’s Substack to keep reading this post and get 7 days of free access to the full post archives.