Macro Memo: Equities, Risk, and the Path Forward

A comprehensive macro update

To stand out in the markets, or any field, the quality of your thinking is crucial. It's not just about the data you have, but how you interpret and apply it. In public markets, everyone has access to the same information. When earnings reports or economic data are released, algorithms and millions of traders are poised to react instantly. Even if you're not consciously thinking about those on the other side of your trades, they are very much there, influencing outcomes.

Without continuously developing an informational edge—something that gives you a real advantage over other market participants—failure is almost certain. This is why I emphasize the importance of my macro updates, which you can find here:

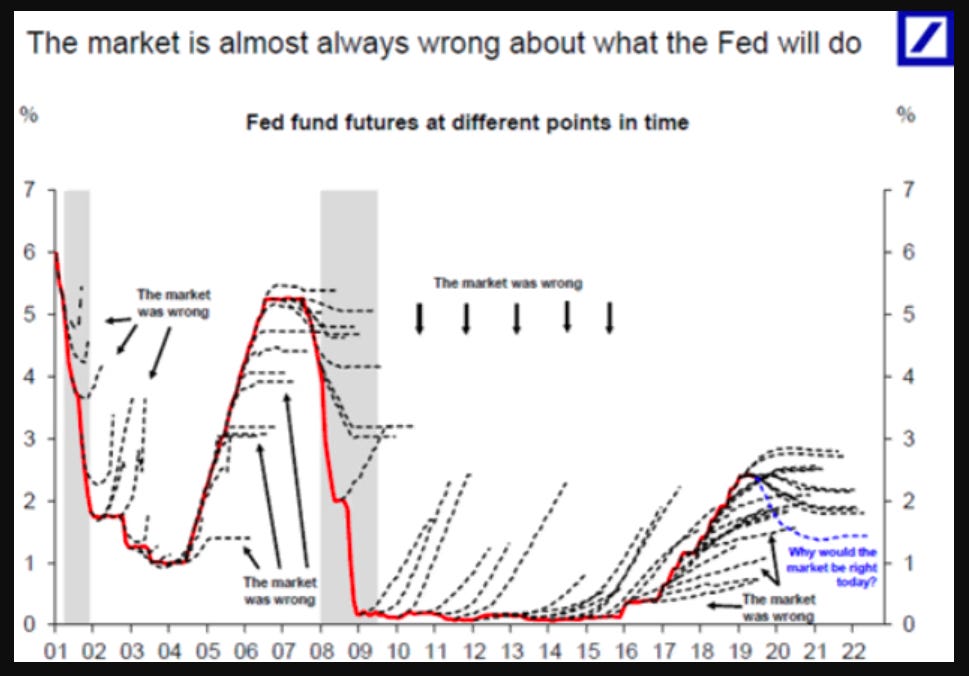

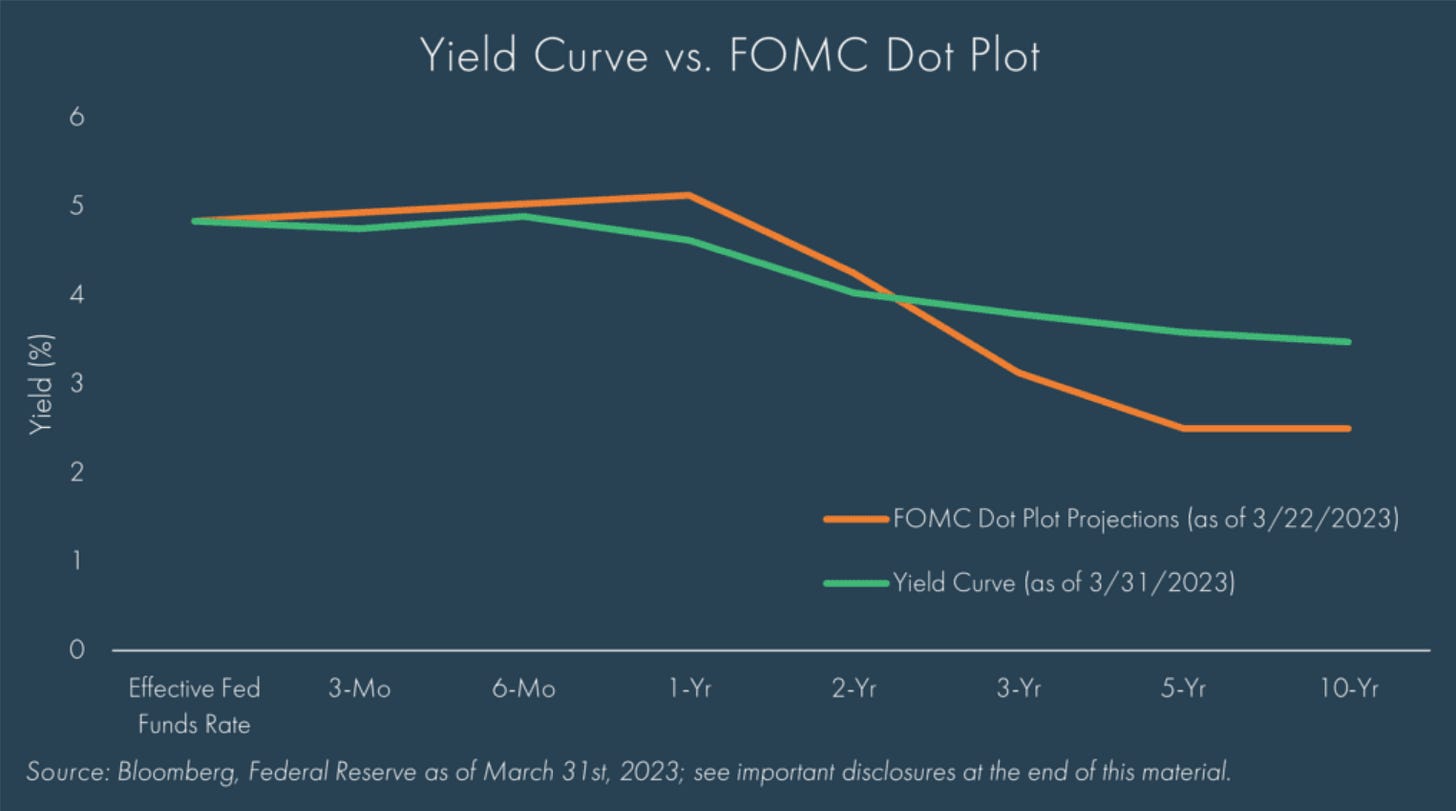

Before diving into my specific views on interest rates and the trades I'm currently executing, it's important to understand a key concept about interest rates and inflation. The market is constantly pricing in the risks associated with future uncertainties. Consequently, there is always an implicit expectation about what lies ahead. While these indicators respond to current data, they are fundamentally projecting a specific scenario two years into the future. The following charts demonstrate that the anticipated path of rates—whether predicted by the Fed or the market—is almost always off the mark.

There’s always a discrepancy between what’s expected and what actually occurs, which is where opportunities for returns come into play. It’s essential to remember that the market is a platform for transactions between participants. The term “the market is always right,” may come to mind…

This doesn’t suggest that the market's expectations will always come true. Rather, this phrase is often used to excuse a failure to align with the market’s processes. Given that there’s often a significant gap between expectations and reality, how should we interpret market movements? The key principle is path dependency. This approach differs significantly from the traditional “business cycle” analysis. Saying that the market moves in cycles doesn’t provide the full story…

While historical economic data shows patterns of oscillation, comparing these with the expected versus realized paths priced by assets reveals that things are rarely as straightforward as they appear. Moreover, the market's expectations of the future can actually shape the future itself. For instance, if the market anticipates lower or higher interest rates, it begins to price this in, influencing both the economy and financial assets.

There are many moving parts, which is why I always recommend going through past posts I’ve written. With a solid understanding of how the system operates and a real-time synthesis of that knowledge, you can begin to set the stage for making informed bets.

Now, let’s turn our attention to the current macro landscape. In this update, I will cover:

- How last week’s data fits into the broader macro regime I’ve outlined.

- How this connects directly to the risk-reward dynamics and the equity trades I'm executing.

- Why equities have been range-bound since their rally off the August lows.

- The next move for Bitcoin.