The Transition Between Cycles

In the current economic landscape, we are witnessing a critical transition between cycles, characterized by disinflationary forces and sluggish growth. This environment, while seemingly challenging, can be beneficial as it compels central banks and governments to inject liquidity into the economy. Such actions align with the political cycle, where politicians often adopt stimulative policies (a little candy to the kids never hurt anybody) to boost their chances of reelection. These policies typically carry momentum into the following year, fostering further economic activity.

Wall Street vs. Main Street Recovery

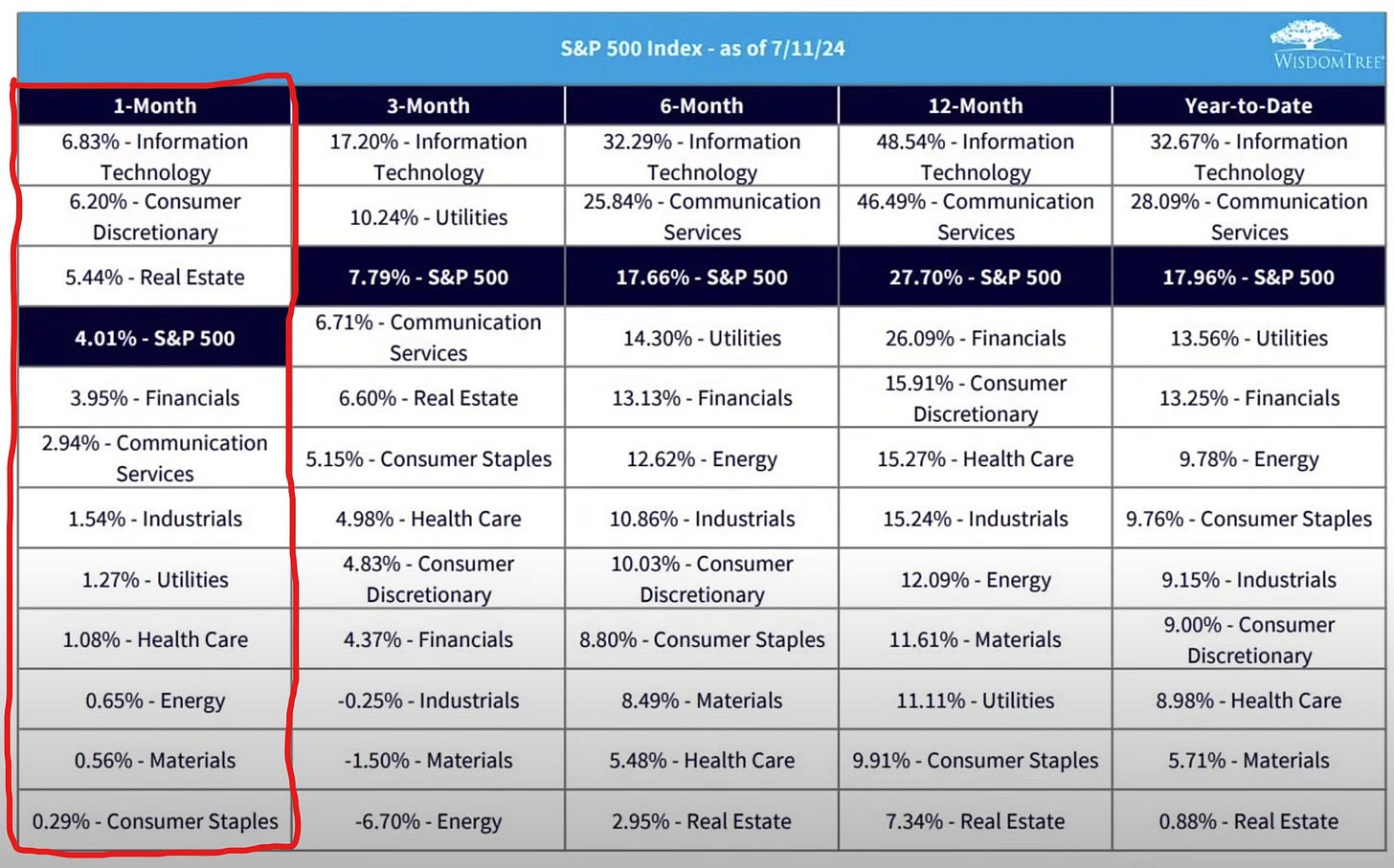

We've already observed a significant recovery in financial markets, often termed a "Wall Street recovery." This phase, marked by strong stock market performances and increased investor confidence, has set the stage for the next phase—a "Main Street recovery." In this phase, the broader economy begins to experience growth, lifting earnings across various sectors. (We can see this in the graphic below as participation has broadened out in the past 45 days.) This uptrend in earnings not only enhances economic growth but also injects additional liquidity into the markets. As earnings flow into the financial system, they contribute to rising asset prices, driven by a combination of liquidity and currency debasement. We're now entering a phase where investment capital is starting to flow back into markets, further propelling prices upward.