Hello Everyone,

I hope you're all enjoying your weekend.

This past week was quite eventful in the markets. Late Sunday night leading into Monday's open, ongoing growth concerns intensified. This triggered a rapid unwinding of the carry trade, pushing USDJPY into the 141s. Consequently, a mass deleveraging occurred, and the short volatility trade took a hit, causing indices—especially the Q’s and Small-caps—to nearly reach their limit down thresholds. However, they managed to recover, marking the week's bottom.

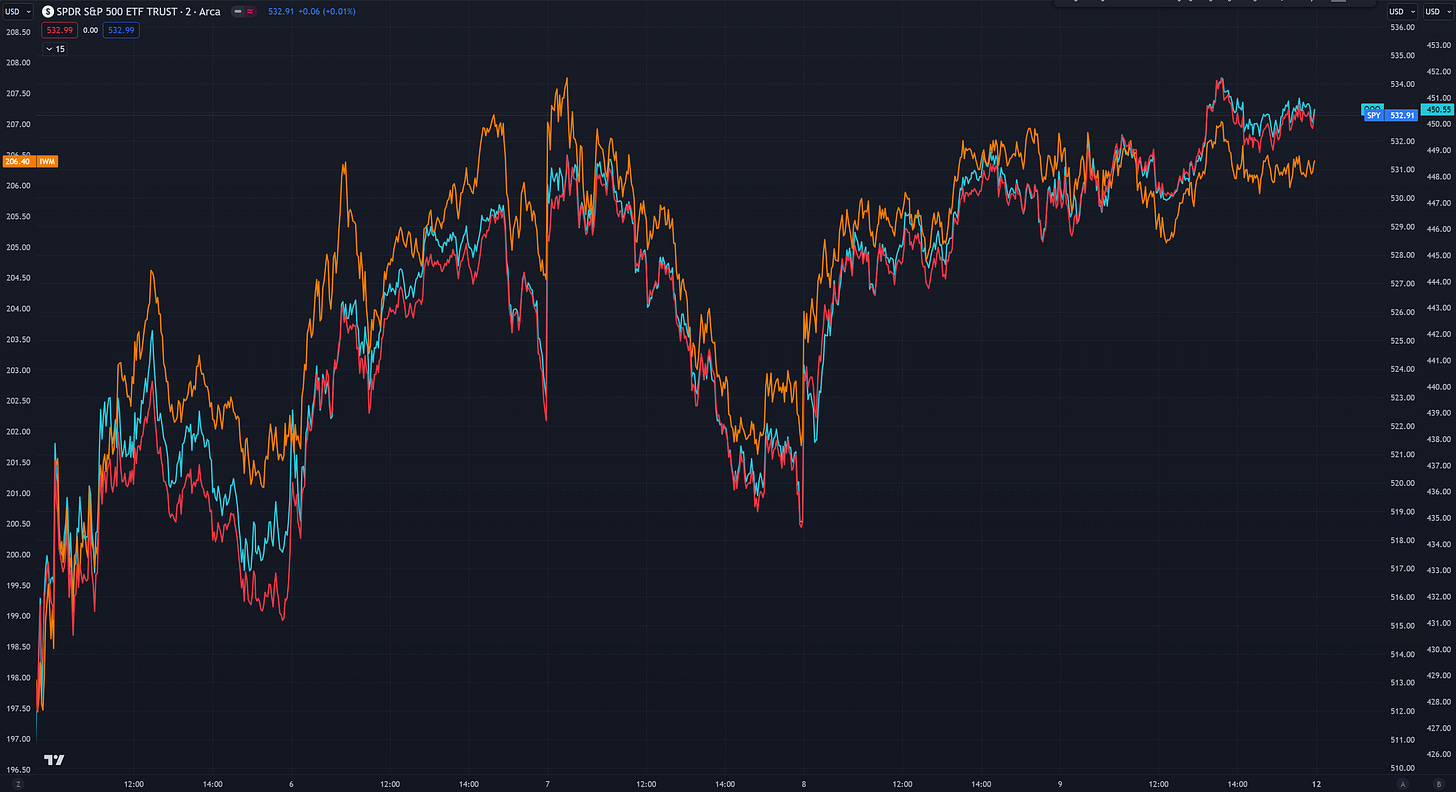

Reflecting on last week, it might have been quiet on the data front, but the markets told a different story. The carry trade unwinding persisted, leading to a gap down in futures on Sunday night. Selling pressure continued overnight, almost pushing indices to a limit down at the open, but they narrowly avoided it. As shown below, once USDJPY (in red) stabilized, the markets found their footing too. This led to a swift rally, with the Nasdaq ending the week in the green after being down over 6% at one point. The S&P 500 also finished flat after a drop of more than 200 points. It was undeniably an exciting week filled with volatility.