Crossroads: Inflation Data, Geopolitical Tensions, and Key Levels to Watch This Week

Weekly Roadmap for 10/06-10/12

Weekly Market Recap

The major indices closed slightly higher this past week, gaining around 40 basis points, while small-caps underperformed, closing down approximately 35 basis points. Although the market remained range-bound, sporadic bouts of volatility emerged, primarily driven by escalating tensions in the Middle East.

Surprising Jobs Report

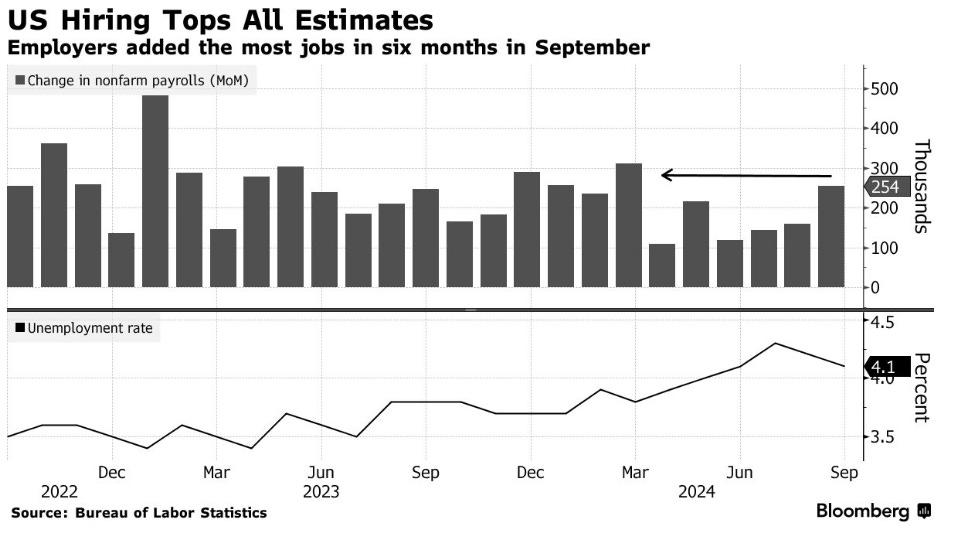

Friday’s jobs report was the standout event of the week. While expectations were set at 150,000, the actual number came in at a robust 254,000, accompanied by a downtick in the unemployment rate (UER) from 4.2% to 4.1%, narrowly missing a clean 4.0% mark. Additionally, prior reports were revised upward, a shift from the recent trend of downward revisions.

Upcoming Economic Data

The coming week looks relatively quiet on the economic front. Notable events include several bond auctions and the release of FOMC minutes on Monday, which are generally uneventful. However, the spotlight will be on the CPI and PPI numbers, which could provide critical insights into whether inflation has truly bottomed, particularly after the recent rebound in growth since early August.

Given last week’s strong jobs report and the decrease in unemployment, the recent 50 basis points cut by the Fed is beginning to appear premature. The risks seem to be shifting from recession concerns to a potential second wave of inflation. The Fed's decision to tolerate 3% inflation to support growth effectively signals an abandonment of the 2% target, a goal unlikely to be achieved without a significant recession, especially considering the persistent fiscal deficits.

In the coming months, if growth continues to rebound, the Fed’s credibility may come under scrutiny. Friday's market action in precious metals suggests that investors are already positioning for a possible resurgence in inflation…