Hello everyone,

I hope you're all having a great weekend and taking some time to step away from the screens.

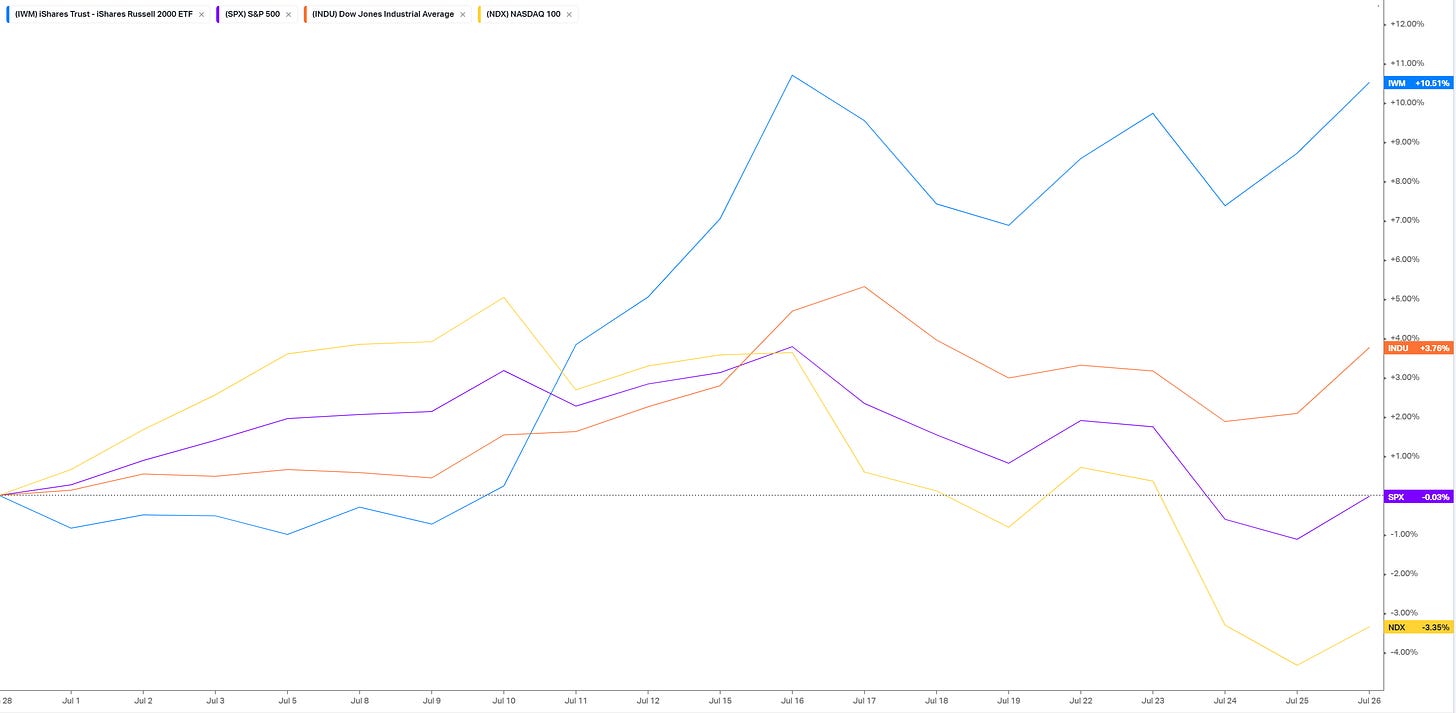

It's been an eventful few weeks in the markets, with deleveraging and the unwinding of crowded positions continuing. Since hitting a low in July, the spread between the Russell and Nasdaq has surged by nearly 20% in a short period.

This has been a challenging period in the markets, particularly with small-cap stocks outperforming following the recent CPI release. This event sparked a wave of deleveraging over the past few weeks, as traders covered crowded short positions in small-cap and cyclical stocks. These positions were previously funding trades in Tech, AI, and momentum stocks. The result? We've seen the Russell and Dow outperform the SPY and Q's for three weeks, creating a significant spread in a short timeframe.

Perspective - Linear Regression in the Indices

SPY

QQQ

IWM

DOW