All-Time Highs, Rate Uncertainty, and Dollar Dips: The Week Ahead

Weekly Roadmap for 01/26-02/01

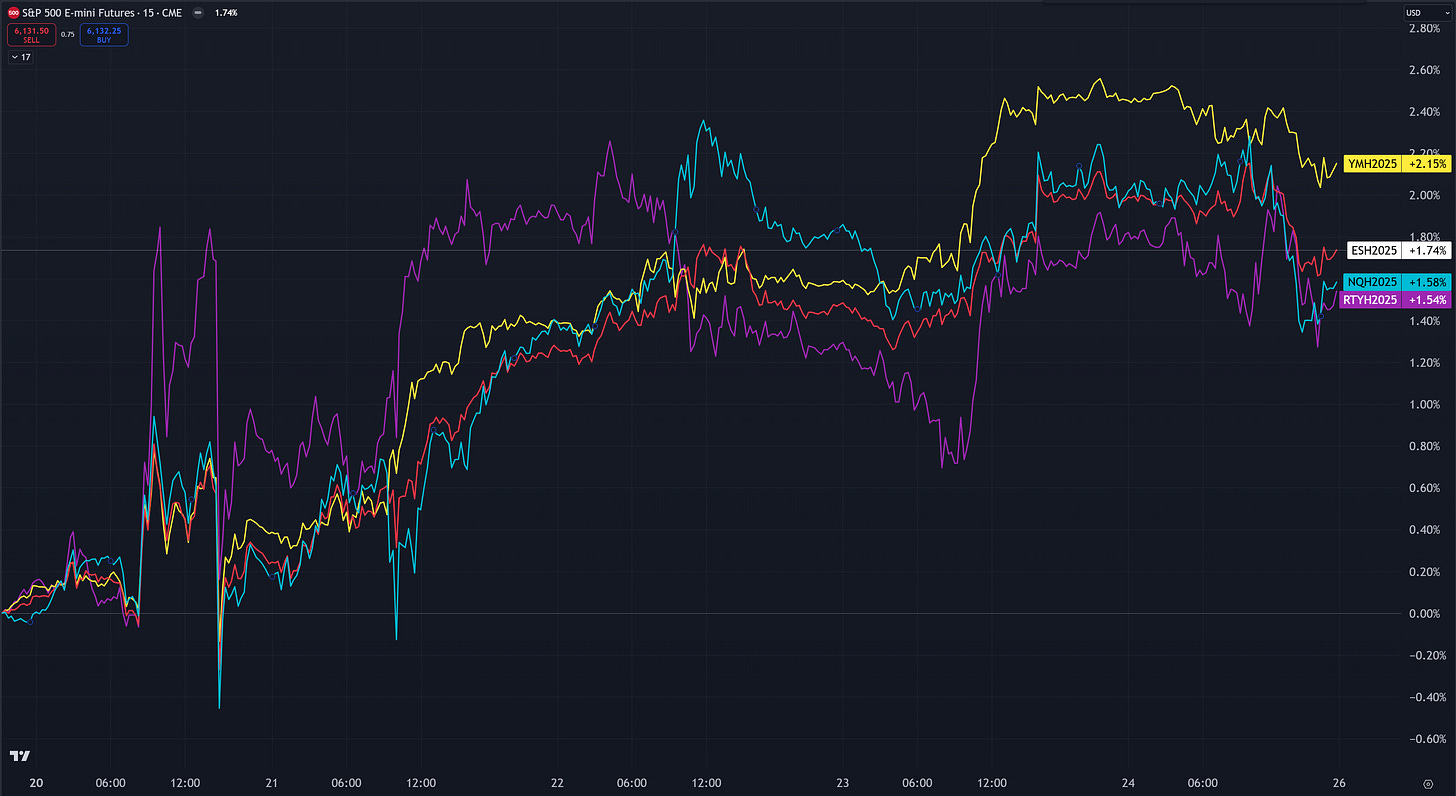

Despite the Monday holiday for MLK Day, last week still packed in plenty of action—most notably, the Inauguration Day festivities marking Trump’s swearing-in. The S&P 500 (SPX) climbed to a fresh all-time high, finishing just above 6100. Across the major indexes, the Dow led with nearly a 220-basis-point gain, while small-caps lagged (though they still notched a respectable 150-basis-point increase).

Economic Data for the Coming Week

Looking ahead, the big highlight is Wednesday’s FOMC meeting. Investors will be eager to see whether Fed Chair Jerome Powell sticks with his hawkish stance from December or reins it in. On Friday, we’ll also get the PCE figures—the Federal Reserve’s preferred inflation gauge—along with a smattering of other economic data scattered throughout the week.

SPY: Where We Stand and What’s Ahead

As we gear up for the week ahead, all eyes are on the FOMC meeting (Wednesday) and PCE data (Friday). This is a particularly important stretch for equities because—if you recall—at the last FOMC, Fed Chair Powell surprised everyone by shifting from a more dovish stance to a hawkish tone. He highlighted the risk of rising inflation (i.e., less likelihood of rate cuts), pointing specifically to the incoming administration’s policies as potential catalysts. Since that meeting, however, markets have been blessed with “goldilocks” data: solid job growth paired with tame inflation. That one-two punch helped the SPX roar back to all-time highs, dragging most major indices along for a nice rebound from recent lows.

The Tariff Talk

A major talking point from Powell was how inflationary tariffs might become. Oddly enough, nearly every other Fed speaker has insisted tariffs won’t stoke much inflation. The new administration seems determined to use tariffs as a negotiating tool, although President Trump recently stated he’d prefer not to use them on China—something few expected to hear. Meanwhile, he says tariffs on Mexico and Canada will take effect on February 1 unless a deal is reached. Again, it’s all part of the “art of the deal,” and so far, these tariff threats haven’t seemed as inflationary as originally feared. In fact, the dollar dropped more than 250 basis points this past week, hinting that the market might view tariff concerns as overblown.

SPX’s Latest Milestone

Looking back at the S&P 500’s performance, we just hit a new all-time high and have now rocketed over 350 handles above the most recent lows. That pullback bottomed out after briefly dipping below the 21-week moving average and from there, the market went into a “stairs down, elevator up” mode

What to Watch for This Week

FOMC on Wednesday: Will Powell double down on his December hawkishness, or will the Fed soften its tone?

PCE Data on Friday: The Fed’s favorite inflation gauge is expected to tick higher. After recent PPI and CPI numbers came in lower than expected, a better-than-forecast PCE could reinforce the idea that inflation isn’t as big a threat—or it could confirm that the Fed isn’t out of the woods if the data surprises to the upside.

We also saw a bit of market jitters on Friday, sparked by buzz around “Deepseek”—an AI/tech story that some investors are hyping, even as they remain skeptical about things like Chinese GDP data. The irony isn’t lost on many, and it did weigh on the tech and AI space heading into the weekend, but SPX still wrapped up near 6100, essentially at record highs.

Strategy & Levels

Keep reading with a 7-day free trial

Subscribe to Blackshore’s Substack to keep reading this post and get 7 days of free access to the full post archives.