Weekly Market Review:

In the past week, we witnessed a notable divergence between the Nasdaq (Q's) and small-cap stocks, primarily driven by rising bond yields and a spike in the 10-year Treasury rate. Early in the week, the rate-sensitive small-caps underperformed significantly, with the Nasdaq outperforming by as much as 300 basis points. However, as the week progressed, this gap narrowed, and by the end of the week, the major indices were performing relatively in line with each other.

Economic Data for the Coming Week:

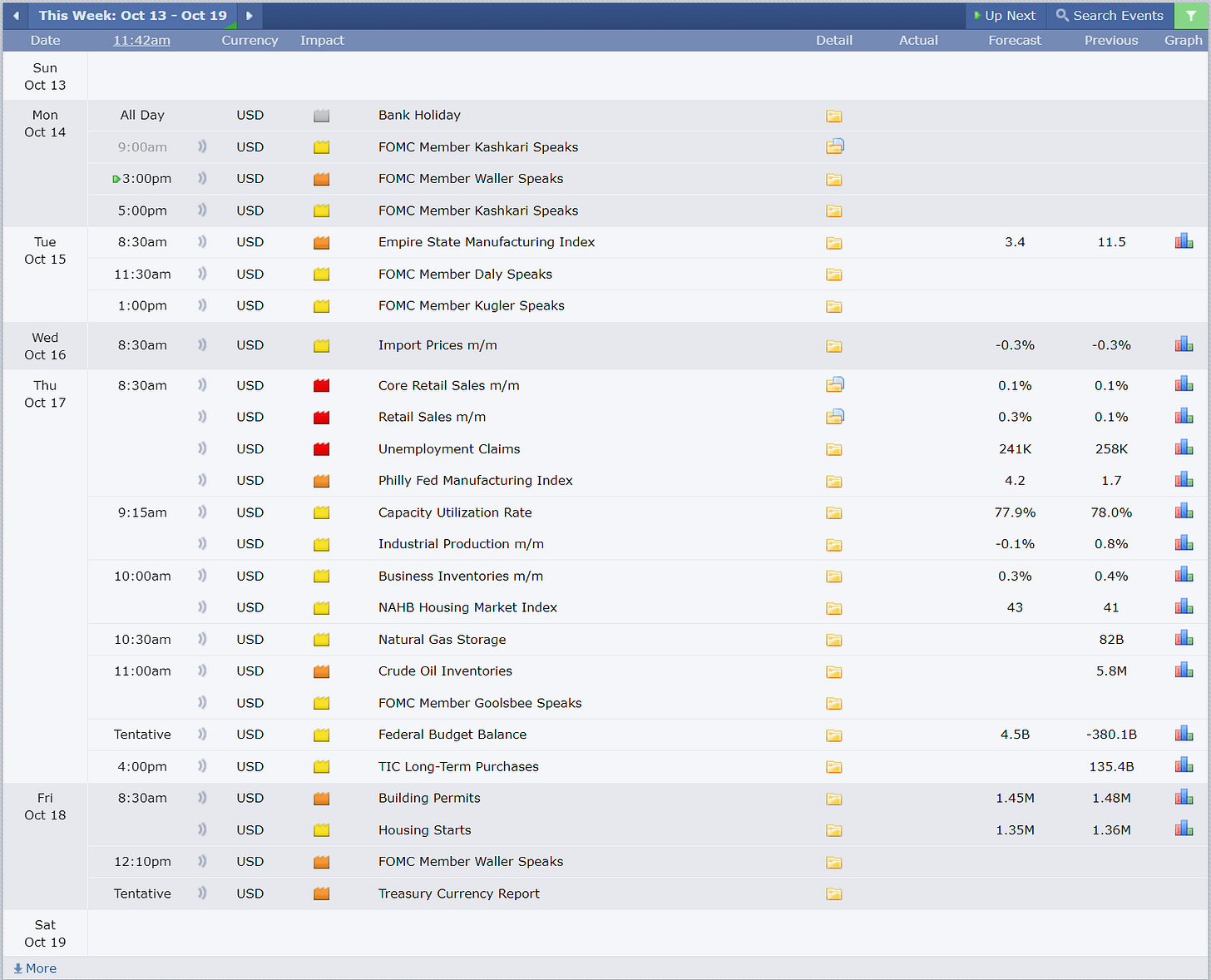

Looking ahead to the upcoming week, the economic calendar is relatively light. The key data point to watch will be Thursday's retail sales report, which will be released alongside the weekly jobless claims. Additionally, a few smaller economic reports are scattered throughout the week, accompanied by remarks from several Federal Reserve speakers.

Inflation and the Fed’s Dilemma:

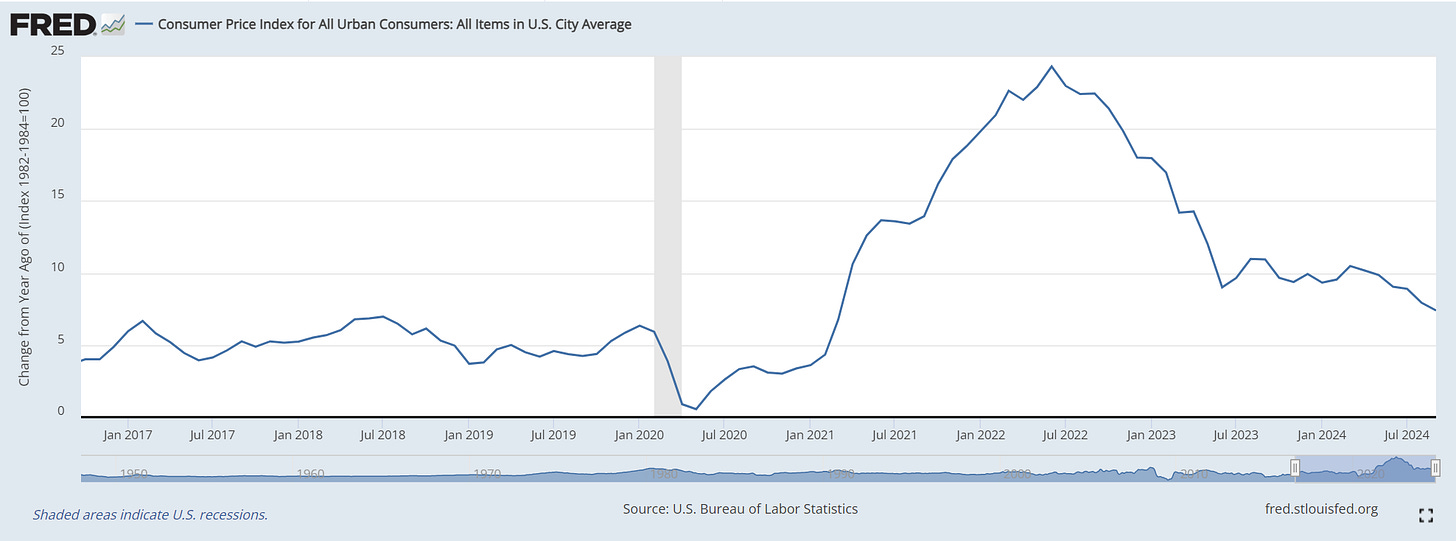

As we reflect on recent developments, the term “policy mistake” has started to circulate, particularly as growth has picked up since early August. With inflation now showing signs of bottoming, the Federal Reserve finds itself in a challenging position. In September, headline CPI increased by 0.18%, while the 12-month rate of change dropped slightly to 2.4% from 2.5%. This was marginally above expectations, as analysts had forecast a decline to 2.3%.

Core CPI also surprised to the upside, rising 0.31% in September, pushing the 12-month rate to 3.3%, up from 3.2% in August. These figures suggest inflationary pressures may be resurging just as the Fed moved to cut rates by 50 basis points.

SPX Outlook: