2025 Macro Memo: A Wild Ride and What Comes Next

2025 Themes, Macro landscape, and more...

What a year 2024 turned out to be. With so many themes emerging, political events stirring the pot, and a “hard landing” that never quite came to fruition, investors and traders had plenty to navigate. We’ve seen fluctuating growth scares, inflation surprises, jumbo Fed cuts, and political drama galore. Where do we stand now? Let’s unpack the big themes and what they might mean going into 2025.

A Rapidly Shifting Narrative

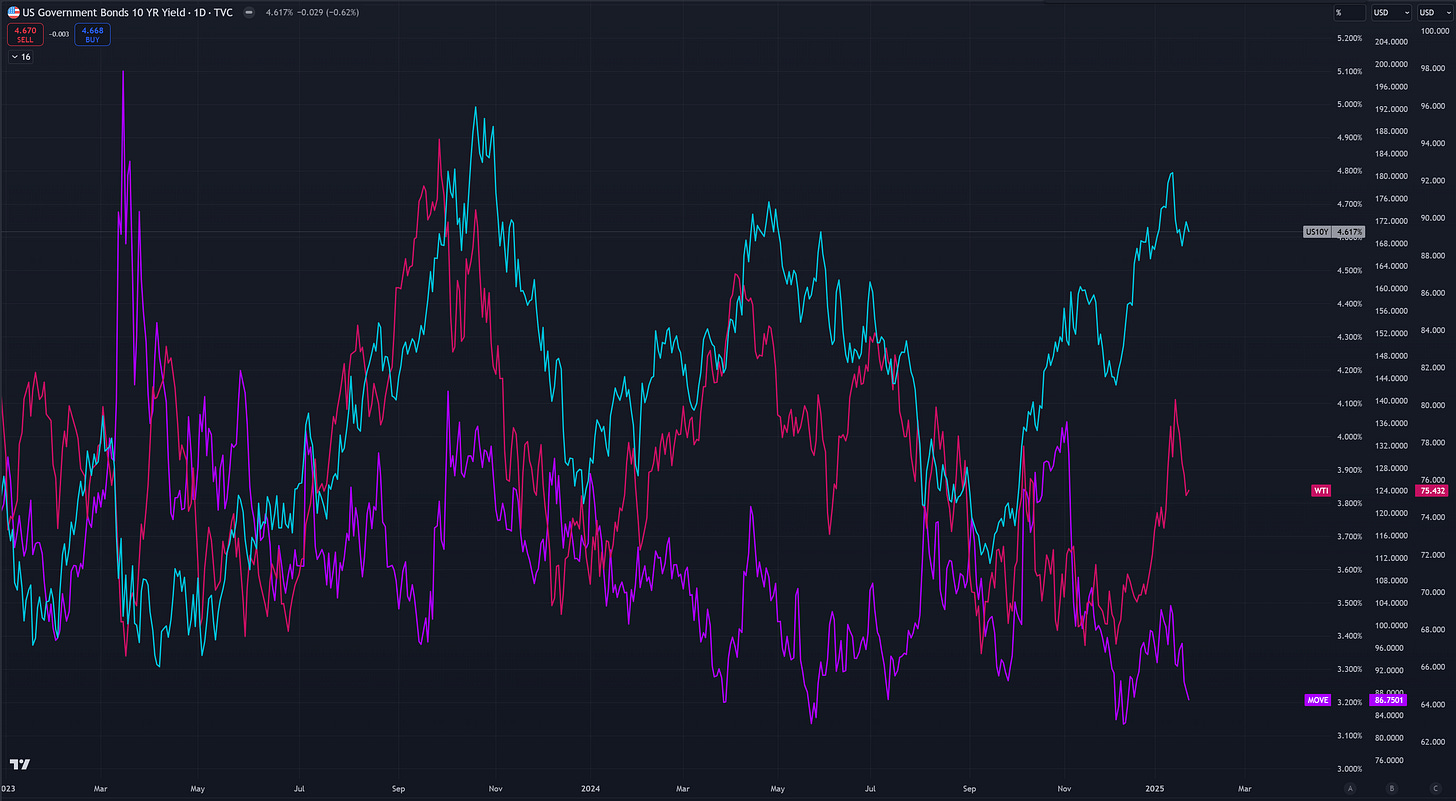

If there’s been one constant in 2024, it’s that the market narrative won’t sit still. In early Q1, traders expected as many as seven rate cuts. By the end of Q2, any cuts were deemed unlikely; chatter of new hikes dominated the headlines. Then came a growth scare in Q3 that drove 10-year yields down to 3.6%. Q4 delivered a total of 100 basis points in Fed cuts, only to be followed by hot inflation and job numbers that suddenly fueled predictions of “no more cuts” in 2025—and maybe even a rate hike comeback. Confused? You’re not alone.

I remain skeptical of such knee-jerk reactions. The story could easily flip again in 2025—so don’t get whiplash trying to keep up.

We’ve seen the 10-year Treasury yield yo-yo between 3.6% and nearly 5%. It’s currently hovering around 4.8%, which I believe is overextended. My target is closer to 4.2%, aligning with its multi-decade “mode”—rather than the often-cited 5.8% mean. High rates can self-correct by slowing growth and inflation, so watch for potential swings back toward lower yields if the economy shows any signs of cooling.

The Fed’s “Jumbo” Rate Cuts and the Easing Cycle

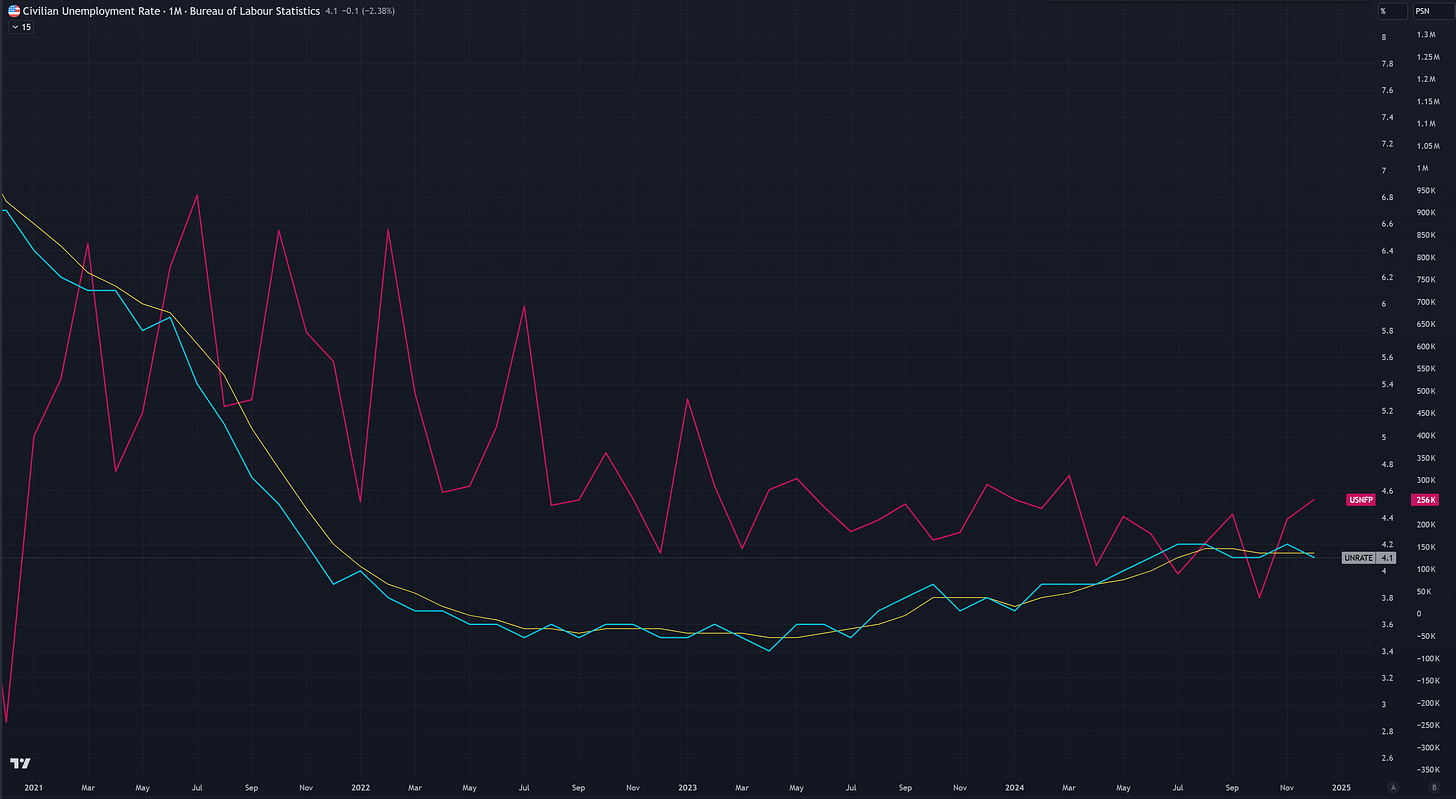

From a macro perspective, I’ve been calling for a soft landing all year, and so far, that view hasn’t steered us too far off course. After what some deemed “substantial” or “jumbo” cuts, the Federal Reserve managed to cool the markets’ concerns about an economic downturn—maybe even a bit too well. We got an initial 50 bps cut, followed by two 25 bps cuts, which spurred job growth and lowered unemployment. Now, the big question is whether inflation will rise faster than the Fed’s comfort zone. Core PCE (the Fed’s favorite gauge) and core PCE ex-housing are both trending higher. January’s CPI offered a sliver of relief for the Fed’s credibility, but one month doesn’t make a trend.

With inflation showing signs of life, the Fed wants to emphasize that, technically, we’re still in a “restrictive” zone. But markets are split: Is the Fed done cutting for now, or will it keep going?

Focus on Rents: A Key Driver of Services Inflation

A hot topic these days is rent inflation, one of the largest contributors to persistent services inflation. It was contained for a while thanks to muted home-price growth and a gradually cooling labor market. But if the economy keeps running hot, there’s a risk rent inflation could reignite.

Still, January’s CPI was reassuring. Shelter inflation remained on the lower end of recent trends, with owners’ equivalent rent (OER) rising just 0.3%. Looking ahead, we see continued softness in rents across Texas and Florida (thanks to ample new housing supply), though there could be some offset in California, where the LA fires are tightening the rental market. Because California makes up a large slice of the CPI basket, we’ll be watching that closely.

The Labor Market: Strong but Not Overheating

Despite earlier growth scares, the U.S. economy is surprisingly robust, and the labor market continues to impress. After President Trump’s election, small-business optimism surged, along with plans for hiring and capital expenditures. From the Fed’s perspective, that’s a mixed blessing—it wants to see solid employment but not a wage-price spiral.

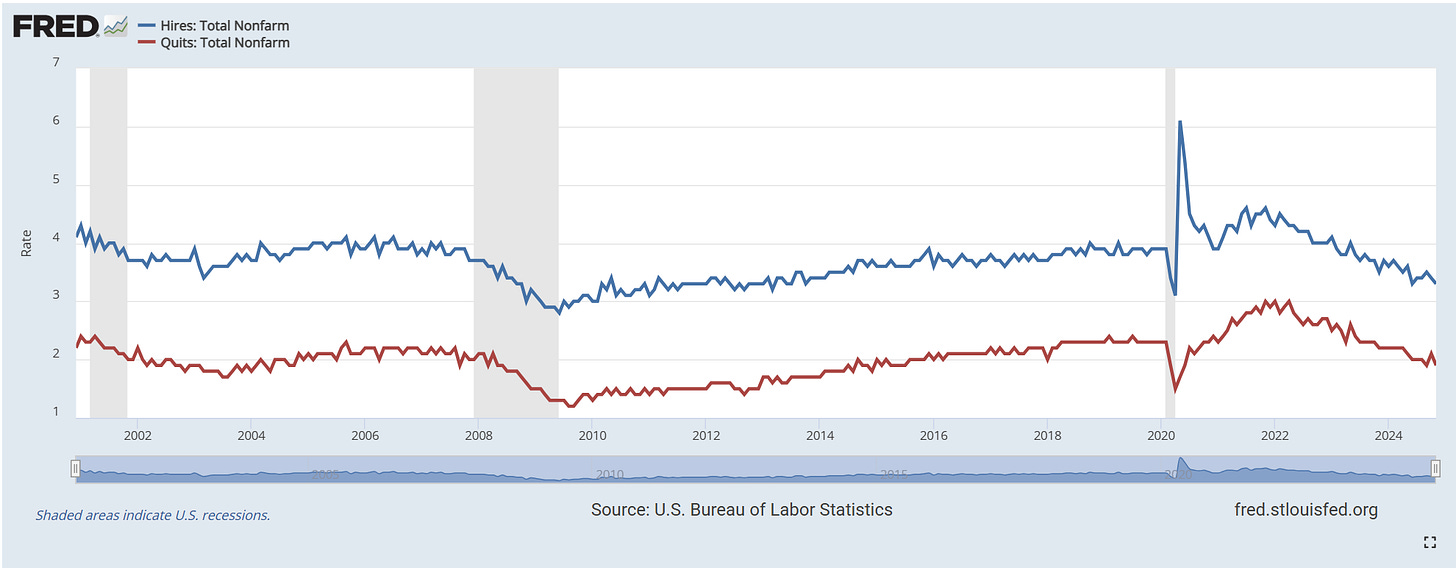

Fortunately, structural indicators like hire and quit rates have been trending downward, hinting the job market may be strong but isn’t spiraling out of control. Wage growth (per the Atlanta Fed) is still above pre-COVID levels but has been easing over time. Historically, rising wages push rents higher, so any slowdown on the wage front should help keep rent inflation in check.

Goods vs. Services Inflation

Right now, core CPI inflation is shaped by cooling services inflation and a moderate rebound in core goods. Trade tensions (think Trump’s tariffs and any potential Chinese stimulus) could complicate this picture, but I’m less concerned about goods inflation overall. China’s economy has been sluggish, and it still has plenty of production capacity. The main risk remains services inflation—particularly rent and hotel lodging.

Fed Chair Powell keeps pointing us to “core services ex-shelter” (in PCE terms) as a key metric. Recently, its CPI equivalent came in softer than expected, which is a plus for the Fed’s fight against inflation. Meanwhile, shelter inflation landed on the lower side at 0.26%. That’s the second-lowest in six months.

Election Clarity, Then Confusion

Before the election, I predicted lower bond-market volatility (MOVE index) and a dip in the 10-year yield once results became clearer. We got that dip—briefly. Then the MOVE index fell, and the 10-year yield reversed course to levels not seen since 2023. This whiplash prompted a new wave of anxiety in equity markets about whether the Fed’s easing cycle might stall. While such anxiety may be overblown, the Fed is treading cautiously, mindful of inflation risks.

January FOMC: What to Expect

Given all the ups and downs since last September—and despite the softer CPI data—the Fed seems almost certain to skip any cuts at the January meeting. They’ll take a “meeting-by-meeting” approach, focusing on inflation as the main risk. Markets may be pricing in a super-hawkish Fed now, but I’m not entirely convinced. If CPI, PPI, and upcoming PCE prints come in soft, sentiment could flip again.

My current forecast is a choppy Q1 for both equities and bonds, thanks to sticky inflation uncertainty. Add in President Trump’s proposed fiscal and trade policies, and you’ve got another layer of complexity. It’s easy to overestimate the inflationary impact of tariffs or deportation plans, but they will likely introduce more volatility. I also wouldn’t be surprised if businesses hold off on key investments until there’s clarity on these policies. That could cool some of the “peak U.S. growth optimism” that’s been reflected in sentiment surveys.

The Fed, the Bond Market, and Rate Volatility

Some traders say the Fed risks “losing the bond market,” because last year’s 100 bps in cuts suggest policymakers don’t take inflation risk seriously. I see it as more of a sentiment mismatch than a fundamental one. Rates could continue to leap or plunge on any soft or hot data. If we get a couple of weaker growth prints, we could quickly see 10-year yields tumbling back to 3.6%.

For many traders, shorting bonds has been a profit machine. But at current yields, I don’t like the reward-to-risk profile. Instead, I favor buying upside call options on TLT as a hedge against economic weakness—especially given our best equity ideas are still in cyclical sectors.

Could the Fed Hit “Pause” for Good?

While I don’t expect it, there’s a scenario where rates stay elevated for a long time, and high real rates eventually weigh on the economy. We might see a replay of late 2023, where the market flips from hawkish bets to a sudden embrace of more cuts if growth takes a dip or inflation cools faster than expected.

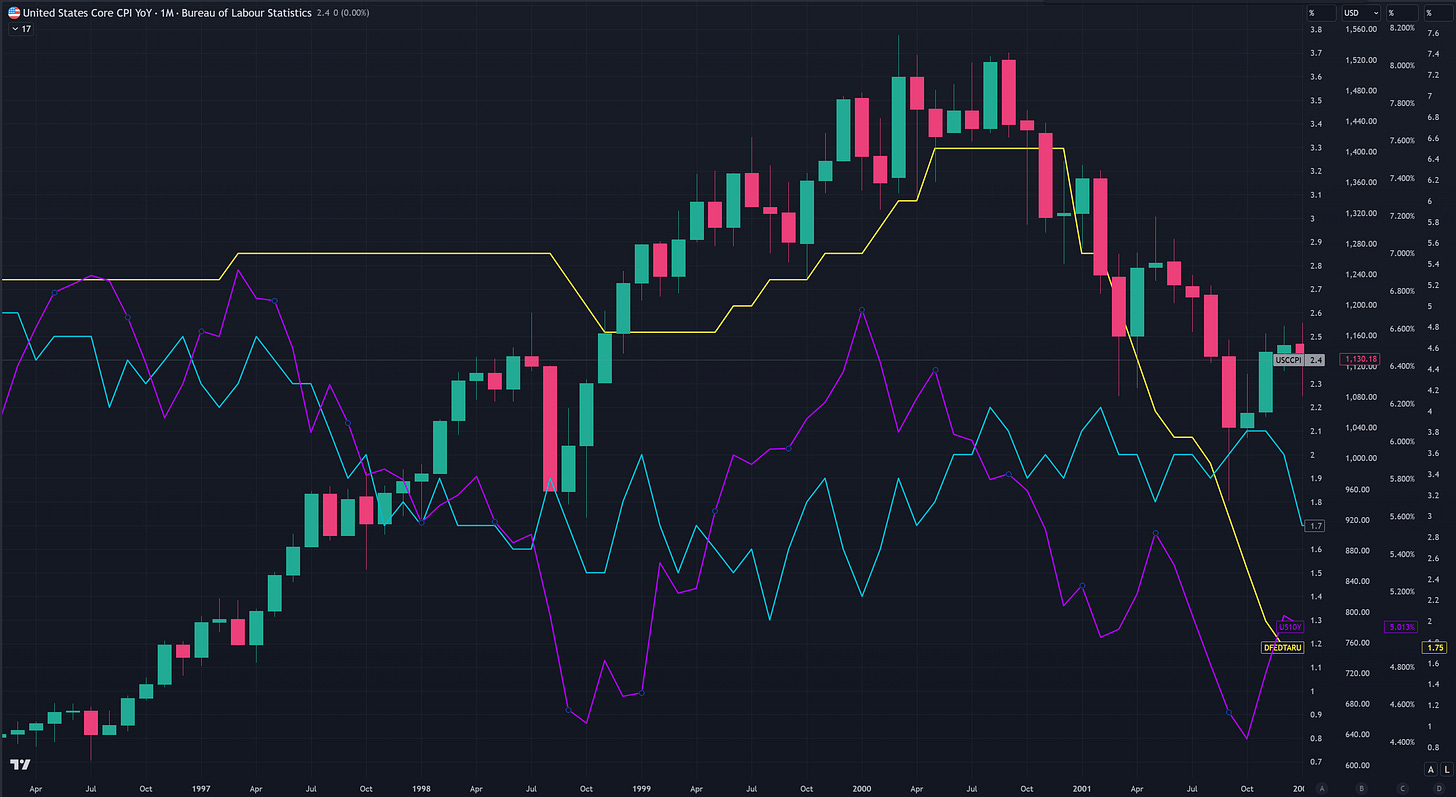

Equities: Lessons from the Late 1990s

To wrap things up, it’s worth recalling a bit of history: in 1998–1999, the Greenspan Fed cut rates four times, then paused. Inflation and the 10-year yield climbed, yet stocks exploded into the Dotcom melt-up. Even after the Fed started tightening again, equities rallied right up until the tech bubble burst, which ultimately led to recession.

No one’s calling for a replay of the Dotcom era, but it shows that higher rates don’t automatically kill a bull market. We can expect 5–15% drawdowns here and there, but the rally can still power on. Understanding these patterns can help us all keep a level head whenever the headlines scream “collapse” or “boom.”

Bottom Line:

The macro narrative has flipped multiple times this year, and more surprises likely lie ahead.

The Fed’s done some big cuts but seems poised to pause until it sees clearer disinflation signals.

Rent inflation and wage growth remain critical to watch—but both look contained so far.

We expect elevated volatility in Q1, driven by inflation uncertainty and potential new trade/fiscal policies.

Shorting bonds at current yields isn’t for us; we’d rather buy TLT calls as a hedge while staying positioned in cyclical equities.

History reminds us that high rates alone don’t guarantee a market meltdown—but volatility is all but guaranteed.

All told, it’s been a wild ride—and there’s likely more to come. Buckle up for 2025.

Disclaimer:

Remember, this is not financial advice. You are fully responsible for your own decisions!

The information provided on this website/Substack is for informational purposes only. While it is believed to be reliable, Blackshore Research does not guarantee its completeness or accuracy. This content is not an offer or solicitation to buy any financial instrument. The information and terms on these pages can change without notice. Unauthorized use of Blackshore Research’s websites and systems is strictly prohibited. This includes data scraping, unauthorized access, password misuse, or improper use of posted information. Your eligibility for certain services will be determined by Blackshore Research and its affiliates. Investment services are not FDIC-insured and carry investment risks, including potential loss of principal. The proprietary information from Blackshore Research or third-party providers is for individual use only and must not be redistributed or transferred without prior written consent from Blackshore Research.